Aug 18, 2022

Saudi Ambition Helps Islamic Bond Market Evade the Global Gloom

, Bloomberg News

(Bloomberg) -- While doom and gloom grip emerging debt markets amid fears of recession and defaults, Saudi Arabia’s sukuk deals are booming.

The kingdom’s domestic-market sales of sukuk -- debt issued under Shariah, or Islamic religious law -- has hit $14.4 billion, up 185% from last year, according to data compiled by Bloomberg. That accounts for more than half of global domestic sukuk sales, and the Saudi government alone sold more than 60% of it.

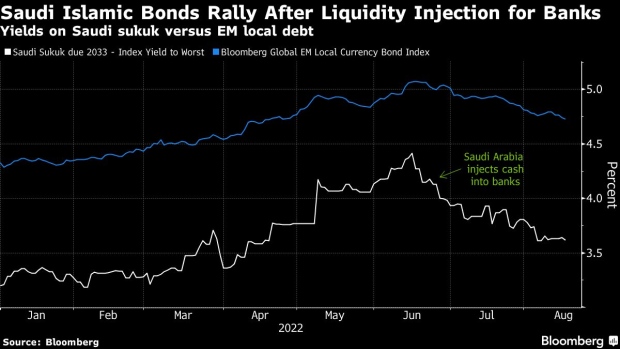

Crown Prince Mohammed bin Salman, the kingdom’s de facto ruler, launched his Vision 2030 plan six years ago to overhaul the Saudi economy and end its reliance on oil. Financing the project is helping cushion the sukuk market from a global downturn that saw eurobond sales drop by more than half this year. Also fueling sales is investor demand for local assets as global debt suffered losses, as well as the central bank’s injection of cash into banks to ease a liquidity crunch.

“There are a lot of projects going on in Saudi driven by their 2030 vision to diversify their economy away from oil. These all need funding,” said Doug Bitcon, the Dubai-based head of credit strategies at Rasmala Investment Bank. “Local investors are familiar with the local companies and they can often raise liquidity at fine spreads.”

Three years after issuing its first local sukuk, the Capital Market Authority allowed foreigners in 2020 to invest directly in listed and non-listed debt instruments to diversify its investor base, but the market remains dominated by local buyers such as funds and insurance companies.

While Saudi Arabia may post its first budget surplus in about a decade as government revenues soar on the back of a rally in oil prices above $100, that hasn’t reduced the need for borrowing. Saudi Arabia’s finance minister said in May that the government would hold excess oil revenues in its current account until at least early next year, as it looks to break an oil-linked boom-bust cycle that has typified the economy in the past.

“From the Saudi investor perspective, local securities are perceived as bearing a relatively low risk,” said Felice Giuggioli, senior advisor at REYL Intesa Sanpaolo, who specializes in Islamic finance. “It is a cash rich country at every level. If there is enough demand at home, why sell in international markets, which is a lot more complex process compared to selling domestically.”

Relative Returns

To be sure, the returns on sukuk notes year to date are more impressive in relative, rather than absolute terms. A group of 56 Saudi riyal Islamic bonds, worth a combined 416 billion riyal ($111 billion), returned a 0.7% loss this year, according to average weighted data compiled by Bloomberg. That compares with a 7.6% loss for local-currency debt from emerging markets as a whole and a 14% loss for dollar debt. The Saudi riyal is pegged to the US dollar.

The yield on Saudi Arabia’s sukuk due 2033 has dropped 80 basis points in the past two months to 3.6% Wednesday.

Another factor driving the surge in sales is buying by financial institutions. The Saudi Central Bank, known as SAMA, in June placed about $13 billion with banks to ease a funding crunch, and some of the funds could be reinvested in the sukuk market.

The surge in issuance “has more to do with the strong liquidity situation of Saudi banks and need to invest the liquidity,” said Sergey Dergachev, senior portfolio manager and head of emerging-market corporate debt at Union Investment Privatfonds GmbH in Frankfurt.

©2022 Bloomberg L.P.