Feb 22, 2019

Saudi Aramco to Build $10 Billion Chinese Refinery With Partners

, Bloomberg News

(Bloomberg) -- Saudi Arabian Oil Co. has agreed set up a joint venture with two Chinese firms to build a $10 billion refining and petrochemical complex, reaffirming its commitment to boost investments in the world’s biggest oil importer.

Saudi Aramco, as the state producer is known, will partner with China North Industries Group Corp., known as Norinco, and Panjin Sincen to form a company -- Huajin Aramco Petrochemical Co. Ltd., it said in an emailed statement. The project will include a 300,000 barrels a day refinery, an ethylene cracker and a paraxylene unit. Aramco will supply up to 70 percent of the crude feedstock for the complex, which is expected to start operations in 2024.

The deal, signed while Crown Prince Mohammed Bin Salman is in Beijing, is part of a strategy to secure demand for Saudi crude by investing in energy assets across the biggest oil-consuming region. Prince Mohammed is on an Asia-wide trip that has already seen him pledge billions of dollars for projects in India and Pakistan. Other investments agreed recently include stakes in South Korea’s Hyundai Oilbank Co. and a petrochemical complex in Malaysia.

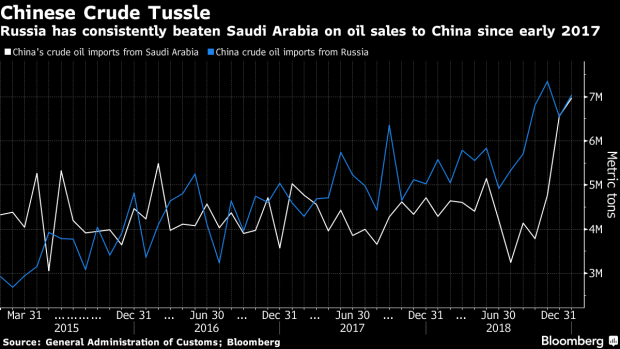

Saudi Arabia is battling for global market share amid challenges posed by U.S. shale oil producers, Russia and fellow members of the Organization of Petroleum Exporting Countries. The world’s biggest crude exporter has been topped by Russia in oil sales to China while competing with incremental suppliers such as the U.S.. The competition has further intensified after OPEC committed to end a global glut, with the Saudis bearing the brunt of the supply curbs.

“Our agreement today with Norinco and the Liaoning province is a clear demonstration of Saudi Aramco’s strategy to move from beyond a buyer-seller relationship, to one where we can make significant investments to contribute to China’s economic growth and development,” Chief Executive Officer Amin Nasser said.

Saudi Aramco will take a 35 percent stake in the new company, while Norinco and Panjin Sincen will hold 36 percent and 29 percent, respectively. Aramco also plans to establish a fuels retail business in China, according to the statement. By the end of 2019, a “three-party Marketing JV Company” is expected to be formed between Saudi Aramco, North Huajin and Liaoning Transportation Construction Investment Group Co. to develop a retail fuel stations network in the target markets, it said.

An initial framework agreement for the Liaoning refinery was first signed during Saudi Arabian King Salman bin Abdulaziz’s visit to Beijing in March 2017. Aramco had announced that it would build a 300,000 barrels-a-day refinery with a 1 million tons-a-year ethylene cracker with Norinco.

Aramco’s looking beyond China as well. It announced plans to take a 20 percent stake in South Korean oil refiner Hyundai Oilbank. It’s also helping finance a $27 billion petrochemical complex in Malaysia and has signed an MoU with Pakistan to build a refinery. The firm also expressed interest in investing in India’s petrochemical manufacturing assets earlier this week.

To contact Bloomberg News staff for this story: Sarah Chen in Beijing at schen514@bloomberg.net

To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net, Ovais Subhani, Andrew Janes

©2019 Bloomberg L.P.