Nov 26, 2018

Saudi daily oil output said to surpass record 11 million barrels

, Bloomberg News

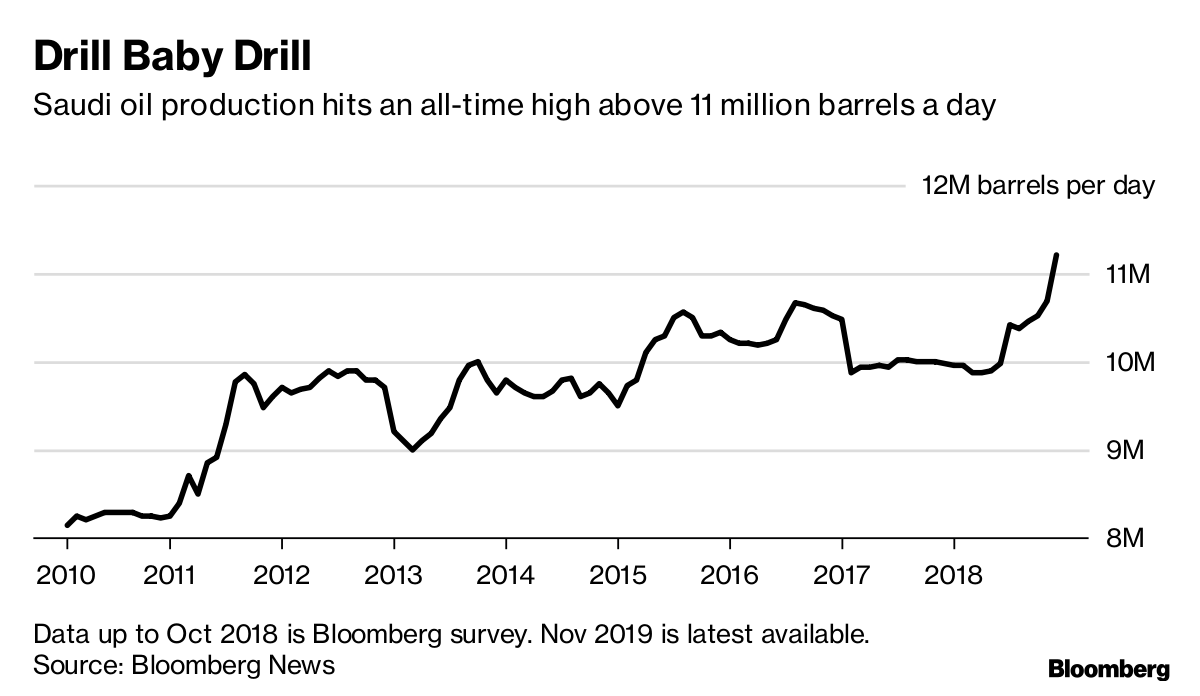

Saudi Arabia is pumping as much as 11.2 million barrels of crude a day, the most since the kingdom extracted its first oil eight decades ago, according to a person familiar with the matter.

The kingdom’s production was running at about 10.8 million to 10.9 million barrels earlier this month as it responded to stronger-than-usual demand from clients preparing for a disruption in Iranian supplies. Saudi Arabia was also using crude from domestic and overseas stockpiles to supplement supply, industry executives said at the time.

It’s unclear if Saudi Arabia plans to keep increasing production, or if it is still supplementing supply from inventories. A Saudi Arabian oil official declined to comment.

OPEC and its allies meet Dec. 6 in Vienna to discuss the group’s 2019 production strategy. Saudi Arabia has already said it supports a drop in output and has pledged to reduce oil exports by 500,000 barrels a day in December, compared with November.

Key decision makers will be at the G20 summit in Buenos Aires later this week, in a meeting that may well decide the direction of oil prices in 2019. Saudi Crown Prince Mohammed bin Salman and Russian President Vladimir Putin, who lead the two largest oil exporters and have been working together to manage the oil market for the past two years, both plan to be in the Argentinian capital.

“In the past, G20 summits have provided the opportunity to negotiate informally the broad contours of the production agreements that OPEC+ members have later ratified,” said Amrita Sen, chief oil analyst at Energy Aspects Ltd. in London.

Khalid Al-Falih and Alexander Novak, the Saudi and Russian energy ministers, are also scheduled to travel to Buenos Aires, according to people familiar with their plans. Their presence reinforces the impression that Saudi Arabia and Russia will try to reach a deal before the OPEC meeting a few days later.

OPEC is under pressure from U.S. President Donald Trump to keep driving oil prices lower. Brent crude, the global benchmark, dropped more than 30 percent over the last two months, falling to a low of US$58.41 a barrel last week. That compares with a four-year high of US$86.74 in early October.