Sep 20, 2020

Saudi Firms Start Talks to Form $11 Billion Petrochemicals Maker

, Bloomberg News

(Bloomberg) -- Saudi Industrial Investment Group and National Petrochemical Co. started talks to merge, potentially creating a firm with $11 billion in assets as Middle Eastern energy companies assess their options in a lower oil-price environment.

The talks are at an initial stage and no agreement has been reached, the companies said Sunday. Saudi Industrial owns 50% of National Petrochemical.

The potential merger comes as energy companies in countries such as Saudi Arabia, Qatar and the United Arab Emirates restructure their operations to cope with a market that’s under strain from lower demand.

Last year, Saudi International Petrochemical Co. completed a buyout of Sahara Petrochemical Co. It was followed by Saudi Aramco buying a majority stake in the kingdom’s largest chemical maker in a deal that was valued at about $70 billion.

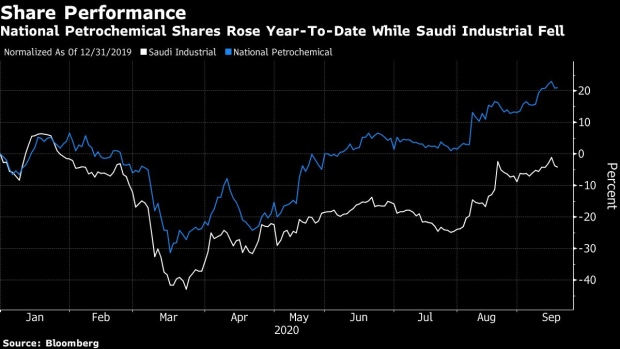

National Petrochemical’s shares climbed 21% this year, while Saudi Industrial fell 4.2%.

©2020 Bloomberg L.P.