Feb 28, 2021

Saudi Shares Drop as U.S. Pins Khashoggi Murder on Crown Prince

, Bloomberg News

(Bloomberg) --

Saudi stocks fell on Sunday after a U.S. intelligence report said Crown Prince Mohammed bin Salman signed off on the killing of Washington Post columnist Jamal Khashoggi.

The Tadawul All Share Index retreated as much 1%. Rajhi Bank, Saudi Basic Industries and Saudi Aramco dragged the index down the most by points.

While President Joe Biden’s administration imposed only modest new sanctions on the kingdom, it is expected to announce more actions on Monday. Saudi Arabia said it “rejects the negative, false and unacceptable assessment in the report.”

“We could see some influence in the sale of arms to Saudi Arabia” Alia Moubayed, the chief economist for Middle East, North Africa at Jefferies International, said in an interview to Bloomberg TV. “But in terms of flows, unless sanctions hit particular asset classes, I don’t see flows being significantly affected.”

Trading in Riyadh was also pressured by a slump in emerging markets shares on Friday, when the MSCI EM Index fell 3.2% as a sell-off in Treasuries triggered a slide in risk assets. Also oil futures, the country’s biggest export, finished 1.1% lower in London on Feb. 26.

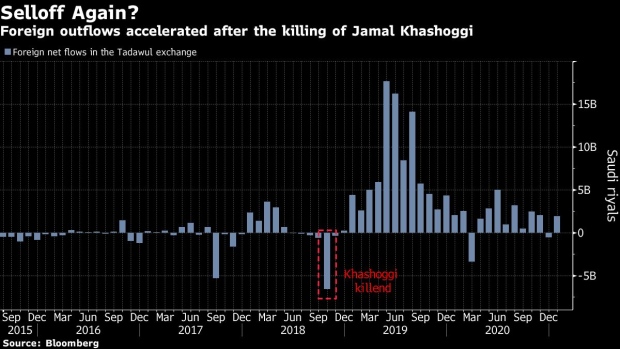

Foreign outflows in the Saudi stock exchange hit a record of 6.6 billion riyals ($1.76 billion) in October 2018, the month when Khashoggi was killed in Istanbul. It was the biggest selloff by foreigners for a month since the country opened up its stock market to foreign investors in 2015.

©2021 Bloomberg L.P.