Jul 19, 2019

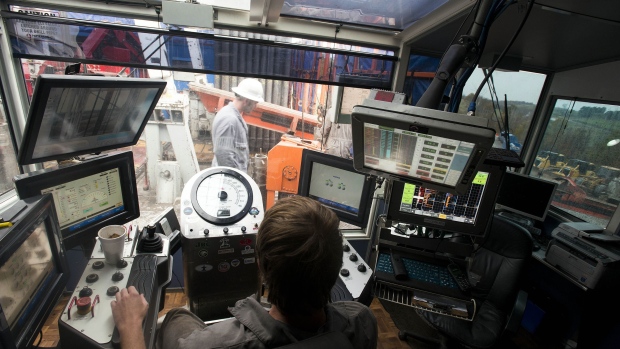

Schlumberger sees shale output boom slowing on budget cuts

, Bloomberg News

The shale boom is about to hit a speed bump, according to the world’s biggest oilfield service provider.

Schlumberger Ltd. expects surging oil production from North American shale basins to slow as explorers cut spending, outgoing Chief Executive Officer Paal Kibsgaard said Friday during the company’s second-quarter earnings call. A recent spree of mergers and acquisitions in the industry is accelerating the move away from growth, he said.

“The consolidation among North American E&P companies is further strengthening the shift away from growth focus towards financial discipline,” Kibsgaard said.

The pullback in the shale patch, which comes after the worst crude crash in a generation five years ago, has pummeled the oilfield service industry as producers rein in drilling activity. Schlumberger on Friday named Olivier Le Peuch as its new chief executive officer and, in a surprise move, tapped shale pioneer Mark Papa as chairman to help steer the company through the downturn.

Spending among producers in North America is tracking expectations of a 10 per cent decline this year, Schlumberger said, though the company sees an increase in international activity.