Mar 22, 2023

Scholz Advisers See German Economy Growing by 0.2% This Year

, Bloomberg News

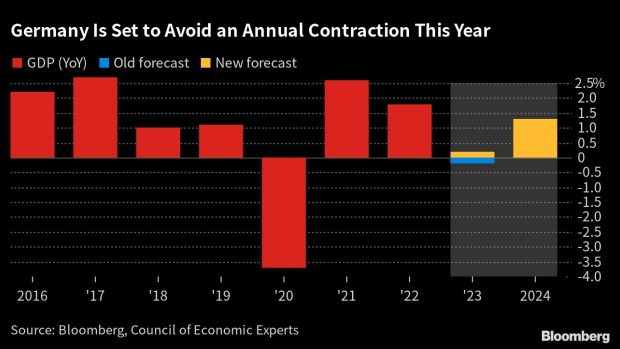

(Bloomberg) -- Germany will likely avoid a contraction this year and is set to eke out growth of 0.2%, Chancellor Olaf Scholz’s advisers predicted, though they warned that the situation remains tense and inflation will continue to weigh on Europe’s biggest economy.

In their latest update, Scholz’s independent Council of Economic Experts said they expect expansion to accelerate to 1.3% next year, even as rising interest rates squeeze households and companies and crimp investment. They had predicted in November that the economy would shrink by 0.2% this year.

“The loss of purchasing power due to inflation, less favorable financing conditions and the slow recovery in external demand are preventing a stronger upturn this year and in the coming year,” Monika Schnitzer, the chair of the five—member panel, said Wednesday in Berlin.

Germany’s economy has been showing signs of improvement in recent months, though a mild technical recession — with two consecutive quarters of contraction between the end of last year and the first quarter of 2023 — cannot be ruled out.

Fears about risks in the banking sector fueled by the rescue of Credit Suisse Group AG and headwinds from inflation sparked a decline in investor optimism for the first time in six months in March, a gauge compiled by the ZEW institute showed Tuesday.

Scholz’s advisers see Germany’s annual inflation rate at 6.6% this year, down only marginally from 6.9% in 2022, before it slows to 3% next year.

Council member Ulrike Malmendier noted that the rate is still a long way from the European Central Bank’s goal of 2% and a further tightening of borrowing costs will therefore be necessary this year.

At the same time, “the high level of uncertainty on the financial markets in recent weeks is making it more difficult for central banks to combat inflation,” said Malmendier, who is also a professor of finance at the University of California.

The advisers said that the bankruptcy of Sillicon Valley Bank and the woes of Credit Suisse have increased uncertainty in the financial markets. However, they highlighted that the turmoil has not been triggered by “worthless financial products” as during the 2008 financial crisis and said that “financial stability should therefore not be at risk.”

The median forecast in Bloomberg’s monthly analyst survey is for a 0.3% decline in German GDP between January and March, after a 0.4% drop in the fourth quarter. The economy is expected to return to growth in the April-June period, with expansion seen accelerating in 2024.

The five council members, who are all professors of economics and finance, are Monika Schnitzer, Veronika Grimm, Ulrike Malmendier, Achim Truger and Martin Werding.

--With assistance from Craig Stirling, Chris Reiter and Zoe Schneeweiss.

©2023 Bloomberg L.P.