Apr 8, 2022

Schultz's early moves at Starbucks suggest deep changes coming

, Bloomberg News

Jason Del Vicario discusses Starbucks

In his first week back on the job at Starbucks Corp., Howard Schultz made a flurry of moves that hint at big changes in store layouts, employee relations and marketing -- and indicate profit margins will be under pressure.

The man credited with inventing Starbucks’s culture as a “third place” for people to spend time beyond their homes and workplaces isn’t taking his new role as interim chief executive officer lightly. He’s already frozen stock repurchases that were part of a US$20 billion package, saying the money would be better spent on employees and cafe improvements. And he dismissed the company’s top lawyer while pledging to offer better benefits for workers to dissuade them from unionizing.

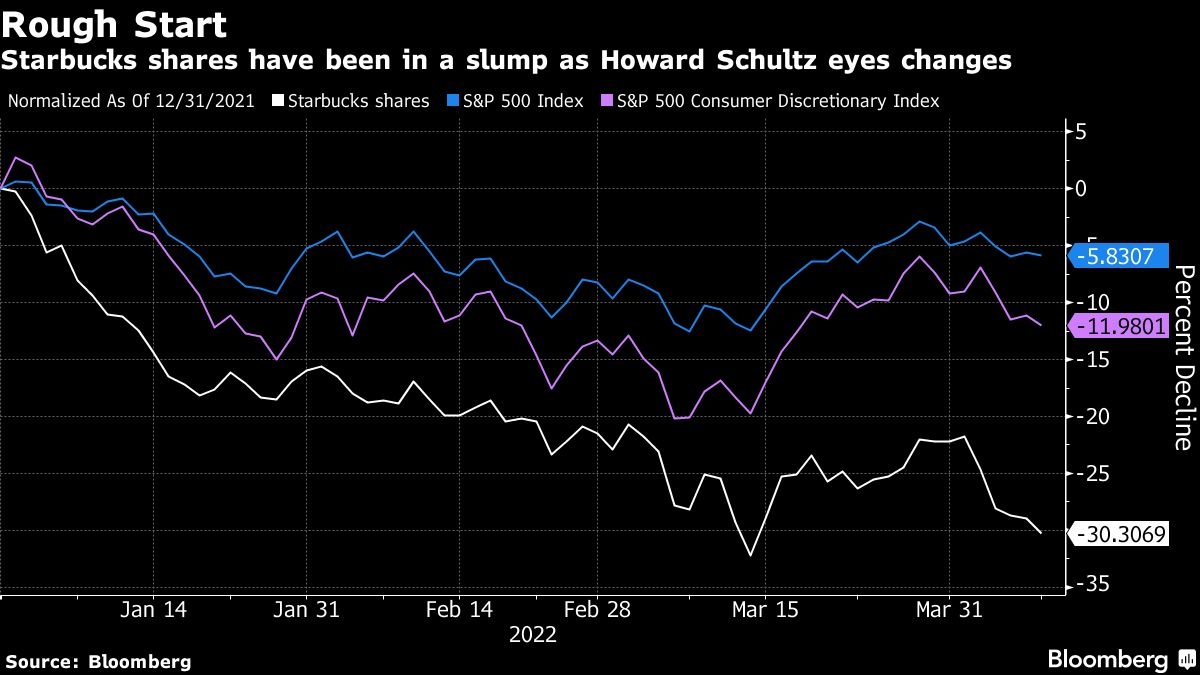

Shareholders greeted Schultz’s plans by selling off the stock, which dropped every day this week for an 11 per cent skid. It’s a sensitive time because Starbucks is already facing a barrage of expenses. In February, the chain said it was seeing a surge in costs for isolation pay and training its workers, along with supply-chain hiccups related to the pandemic. Estimates compiled by Bloomberg project operating margin will narrow to 16.3 per cent this fiscal year, down from 16.8 per cent last year.

“He’s coming back and he’s making bold moves,” said Ivan Feinseth, an analyst at Tigress Financial Partners who has a buy rating on the stock. Feinseth thinks investing in the long term is the right idea even if there’s some short-term pain.

“It’s going to pressure margin, absolutely, but I don’t think it’s a factor. He knows that.”

Feinseth said Schultz’s changes may include expanding into selling food and wine into the evening hours -- a move the company has experimented with in the past. “They’re still going to try to address things that will drive traffic at night,” the analyst said. “He wants to further the premium experience.”

Schultz led Starbucks’s aggressive expansion in the 1980s and ’90s before stepping down as CEO in 2000. He returned again as CEO from 2008 to 2017. In his third go-around, the 68-year-old is also rejoining the board and handling day-to-day operations as the company searches for a new leader -- a process that it expects to be completed by the fall.

LATTE OR GAS?

Profit estimates have come down about 3 per cent since the year began as inflation picked up and Russia’s invasion of Ukraine roiled commodities markets. A tall latte at US$4.25 plus tax now costs less than a gallon of gasoline in Seattle, where Starbucks is based.

Inflationary pressures are also hitting core goods like coffee and dairy. Starbucks is less insulated from price increases because it owns and operates individual restaurants, unlike the franchise model used by other chains including McDonald’s and Dunkin’.

Starbucks is raising wages across the U.S. this year to help retain staff. Schultz also told employees that the company will get into non-fungible tokens before the end of 2022 to capitalize on its “treasure trove” of collectibles and rich heritage. He has been meeting this week with workers in China, a key market for growth that’s been under a lot of sales pressure lately with virus resurgences.

Other changes may be in store such as cafe remodels, new menu items and additional technology for the company that pioneered mobile orders and payment in the restaurant industry, said Ben Silverman, director of research at Verity, which advises institutional investors.

Silverman said Schultz’s biggest moves may involve altering the company’s plans for new locations. “Commercial real estate has undergone a lot of change because of people working from home, and not really commuting to the office,” he said. “That changes the equation.”

Schultz said he won’t make every decision based on the stock price or earnings impact. The stock has fallen 30 per cent since the beginning of the year.

All of these moves underscore Schultz’s “long-serving stance as a champion for change,” said Brett Levy, an analyst at MKM Partners. While the strategy may pressure margins, it could also help Starbucks refocus on organic growth and shareholder returns, he said.

“These next two quarters should not expect to see him sit idly by as a placeholder awaiting a permanent replacement,” Levy said in a research note.