Oct 11, 2022

Scotiabank analyst cuts price targets for several transportation, aviation stocks

, BNN Bloomberg

Warehouses are still plugged and retailers have to move the inventory out: CEO

An analyst at Scotiabank has cut price targets for almost every transportation and aviation stock on his coverage list, citing concerns around how a potential recession could impact these sectors.

Konark Gupta, analyst at Scotia Capital, cut the price targets of eight companies by an average of 12 per cent, out of the 14 companies he covers.

The companies that Gupta cut price targets for include: Air Canada, Andlauer Healthcare Group Inc., Bombardier Inc., CAE Inc., Chorus Aviation Inc., Cargojet Inc., Héroux-Devtek Inc. and Transat A.T. Inc.

“As investor concerns are picking up that the Fed’s hawkish approach could trigger a downturn, we are making even more cuts to our long-term estimates across our coverage universe while also incorporating the effects of CAD weakness,” Gupta said in a note to clients Tuesday.

“Although the path remains unclear, we are of the view that a potential recession could be less damaging for the aviation sector than freight transportation as consumption is shifting toward services (including travel) from goods coming out of the pandemic.

FINDING VALUE IN AIR CANADA

Gupta said he sees value in Canadian airline carriers, and thinks they could grow through a potential recession “given they are still emerging from the pandemic while forward bookings are trending up, currently led by international travel.”

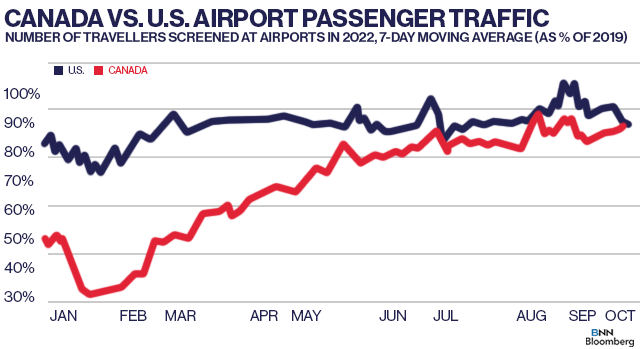

“AC (Air Canada) is still emerging from the pandemic due to Canada’s delayed reopening vs. other major markets (e.g., the U.S.), while inflation and fuel/FX headwinds are incrementally delaying the margin recovery,” he said.

“Air travel demand appears to be trending up despite macro headwinds while labour shortage continues across the industry.”

Despite reducing his price target to $25 from $26, Gupta maintained his sector outperform rating (the equivalent of a buy.)

DOWNGRADING MULLEN GROUP

Gupta maintained ratings for all of the stocks on his list aside from Mullen Group Ltd., which he downgraded to a sector perform from a sector outperform.

He said the threat of higher inflation, rate hikes and a slowdown in acquisitions, caused him to downgrade the stock.