Aug 24, 2022

Scotiabank Hit by Wave of Downgrades After Earnings Fall Short

, Bloomberg News

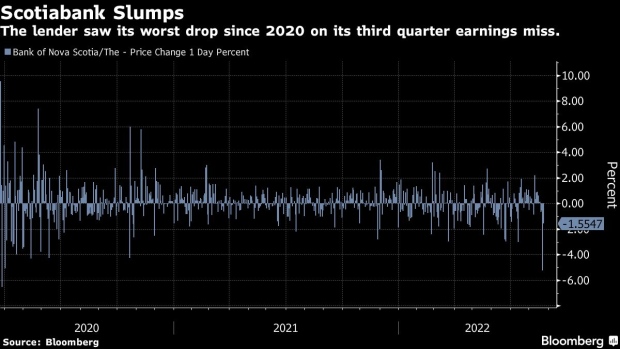

(Bloomberg) -- Analysts are ratcheting down their ratings on Bank of Nova Scotia after the country’s third-largest lender’s weak international banking results weighed on earnings, sending its share price to its worst drop since the pandemic ravaged markets.

At least four analysts downgraded their recommendations for the bank after its fiscal third-quarter revenue and profit came in below analyst expectations. The shares continued their slump Wednesday, extending their rout to more than 7% over two days -- its biggest plunge since March 2020.

Keefe, Bruyette & Woods, BMO Capital Markets, RBC Capital Markets and Veritas Investment Research cut the stock to hold from buy. The analysts cited the worsening macroeconomic environment, which could weigh on the bank’s Latin American-focused international division.

“Most concerning was the bank’s International Banking segment, which had an underwhelming top-line that drove a modest sequential decline in pre-tax, pre-provision earnings,” KBW analyst Mike Rizvanovic said in a note. “While we continue to have a positive view on the longer-term growth potential of the LatAm business, which is poised for a stronger 2023, we believe the less robust nearterm outlook for International limits Scotiabank’s upside relative to peers for the time being.”

Canadian banks fell broadly Wednesday, led by Royal Bank of Canada’s tumble of as much as 3.7% on disappointing results on the back of slumping capital markets activity. National Bank of Canada was an outlier, rising as much as 0.9% after the smallest of the Big Six banks posted earnings that topped analyst estimates on a boost in capital markets revenue.

All eyes will be on the last three of the Big Six banks, slated to report quarterly results this week and next with investors searching for more clues on where the Canadian economy will go and what this means for the stock market.

©2022 Bloomberg L.P.