Jan 19, 2022

Scotia sees Bank of Canada hiking rate to 2% to quell inflation

, Bloomberg News

Scotiabank calls January BoC rate hike, 175 basis points through end of 2022

Bank of Nova Scotia says Canada’s central bank will begin an aggressive round of monetary tightening next week to control inflation, bringing its policy rate to above pre-pandemic levels by the end of this year.

The Toronto-based lender is now projecting the Bank of Canada will hike its overnight policy rate to 2 per cent in 2022, from the current emergency level of 0.25 per cent, according to a report published Wednesday, shortly after Statistics Canada said inflation hit its highest in three decades.

Scotiabank forecasts the Bank of Canada will make its first move with a 25-basis-point hike at its Jan. 26 policy decision. That’s expected to be followed by another 25-point hike in March, a 50-point increase in April, and then three more 25-point hikes by year-end.

The more aggressive expectations reflect a growing realization that inflation has become the biggest risk to the economy despite the emergence of a highly infectious COVID-19 variant, according to Scotiabank Chief Economist Jean-Francois Perrault.

“The simple reality is that the very serious public health impacts of omicron and the associated economic consequences do not outweigh the pressing need to withdraw monetary stimulus,” Perrault said in a report to investors.

Before Wednesday’s change, Scotiabank had been projecting the policy rate would rise to 1.25 per cent by the end of this year.

The call makes Scotia the most hawkish among major Canadian banks, though there’s been a rush of economists bringing forward their rate calls in recent days amid growing worries inflationary pressures are beginning to broaden.

What Bloomberg Economics Thinks...

“Consumer prices rising in December at their fastest pace since 1991 will make next week’s Bank of Canada decision a close call for a rate hike. The details showed long-running supply bottlenecks still at play, maintaining pressure on prices of durable goods.”

--Andrew Husby, economist

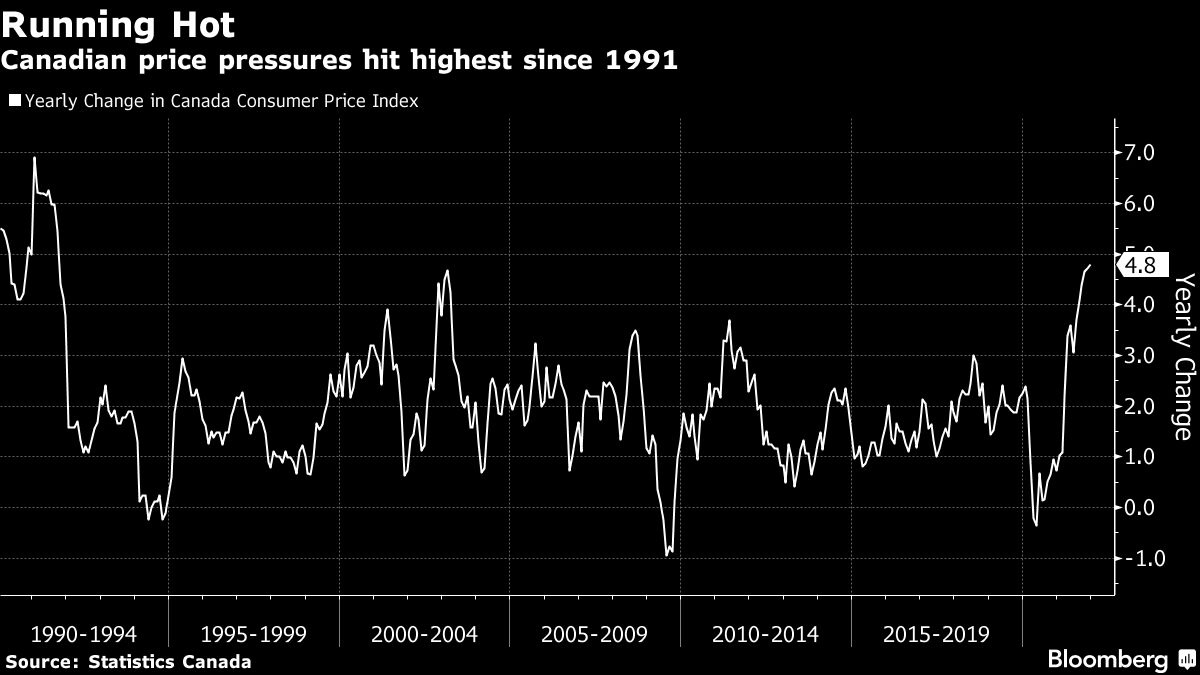

The Bank of Canada, in its fourth-quarter survey of business executives on Monday, described the economy as running increasingly hot, with widespread labor shortages, record inflation expectations and strong demand. Earlier Wednesday, Statistics Canada reported that annual inflation hit 4.8 per cent last month, the highest since the country began targeting inflation.

Consumer price gains have now exceeded the central bank’s 1 per cent to 3 per cent control range for nine straight months as global supply chain bottlenecks push up prices. Since Canada introduced inflation targeting in the early 1990s, the inflation rate has averaged about 1.8 per cent.

Markets are pricing in as many as six increases in borrowing costs over the next 12 months, and see another two rate increases in 2023 to bring the policy rate to 2.25 per cent in two years. Perrault sees Canada’s policy rate rising a bit higher, to 2.5 per cent by early 2023. It was 1.75 per cent before the COVID-19 pandemic hit in early 2020.

Canada won’t be alone. Scotiabank also expects aggressive rate increases form the the U.S. Federal Reserve, which is seen lifting the upper bound of its key policy rate to 2 per cent by the end of 2022. That would represent an increase of 1.75 percentage points from current levels.

“Even with this pace of tightening, the real policy rate would remain negative at the end of this year,” Perreault said.