Mar 14, 2019

Secret Deals on China Distressed Debt Start to Unfreeze Trading

, Bloomberg News

(Bloomberg) -- After record defaults on China’s bonds, there’s now record interest in trading the country’s distressed debt.

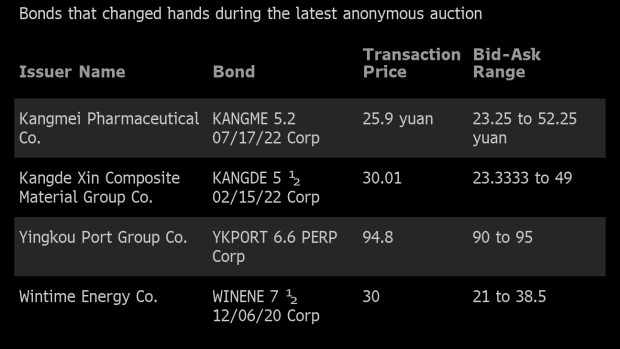

An arm of the central bank that runs the biggest bond-trading platform last month conducted the third auction of distressed securities since July. This one had the biggest participation yet, spanning 43 institutions. While prices of the trades were published by the China Foreign Exchange Trade System, the counterparties’ names were kept secret to maximize deals.

The auctions, which CFETS aims to encourage foreign investors to join in future, are part of China’s broader initiative to introduce more dynamism into the world’s third-largest bond market, at about $13 trillion. Greater clarity on the pricing of distressed securities may boost trading more generally, and improve transparency -- the anonymity of participants notwithstanding -- in what has been an opaque debt industry.

“The anonymous system doesn’t just protect both the buyers and sellers, but also helps make the market so that traders can agree on a good price more quickly,” said Gary Zhou, Hong Kong-based fixed-income director at China Securities International. A lack of liquidity has meant “difficulties for pricing” distressed securities up to now, he said.

The latest round included defaulted notes for the first time, and featured a successful trade on securities from China’s second largest defaulter of 2018, Wintime Energy Co. There’s plenty of potential for more auctions, given a current total of about 400 billion yuan ($59.5 billion) of distressed notes in the country, according to data compiled by Bloomberg. The figure covers notes in default and bonds facing repayment pressure.

China’s history of credit defaults only goes back a few years, and up to now the stigma attached to tainted securities has meant only sporadic trading in such notes via brokerages. It may take time before international investors -- who have been snapping up record amounts of government bonds in the local market -- start biting.

“Lots of distressed trading is happening in the U.S. because it has had about 100 years of bankruptcy code that has been tried and tested, and you have a higher degree of certainty as to how the bankruptcy will play out.” said Teresa Kong, portfolio manager at Matthews Asia. “In China, that’s a big unknown.”

Meantime, CFETS is mulling the inclusion of credit default swaps and junior tranches of asset-back securities in future auctions. A total of 22 bonds were involved in last month’s operation. Wintime’s notes due in 2020 changed hands at 30 percent of their par value, with a wide bid-ask range of 21 to 38.5, according to CFETS.

“China is now witnessing a growing distressed-debt market,” said Li Kai, multi-strategy investment director at Genial Flow Asset Management Co. “It’s been a pressing task to develop a system for trading distressed debt, and adding defaulted notes into the anonymous auction plays a significant role to achieve that goal.”

--With assistance from Molly Dai.

To contact Bloomberg News staff for this story: Tongjian Dong in Shanghai at tdong28@bloomberg.net;Jing Zhao in Beijing at jzhao231@bloomberg.net;Xize Kang in Beijing at xkang7@bloomberg.net

To contact the editors responsible for this story: Neha D'silva at ndsilva1@bloomberg.net, ;Christopher Anstey at canstey@bloomberg.net, Lianting Tu

©2019 Bloomberg L.P.