Dec 13, 2017

Senate committee urges Morneau to abandon or delay controversial tax plan

A prominent senate committee is urging the federal government to abandon plans to change the way small businesses are taxed in this country.

The Senate Finance Committee published a report Thursday offering three recommendations on how to move “toward a fairer tax system.” The first two urged Finance Minister Bill Morneau to “withdraw his proposed changes” and to instead “undertake an independent comprehensive review of Canada’s tax system.”

Failing that, the committee said if Morneau decides to proceed with his plan he should “delay [its] implementation until at least” the start of 2019.

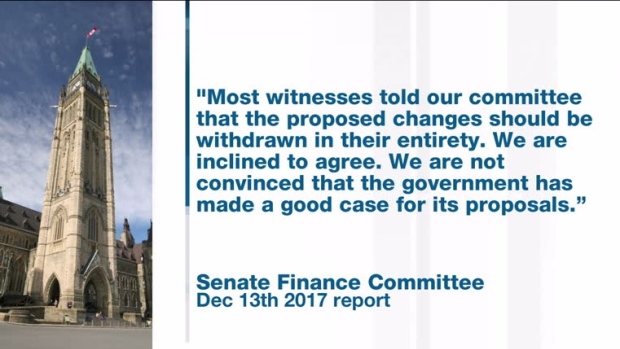

The report was based on 30 meetings held across the country where 138 witnesses presented testimony and another 32 witnesses made written submissions.

“Most witnesses told our committee that the proposed changes should be withdrawn in their entirety,” the committee’s report said. “We are inclined to agree. We are not convinced that the government has made a case for its proposals.”

Facing intense criticism from small business owners nationwide since Morneau first released his proposal in July, the government walked back several elements of the proposal shortly after consultations ended in October.

Plans to limit conversion of business income into capital gains were nixed amid fears they would impact succession planning and a passive investment income threshold of $50,000 was added to allow entrepreneurs to continue using what had become a popular savings vehicle.

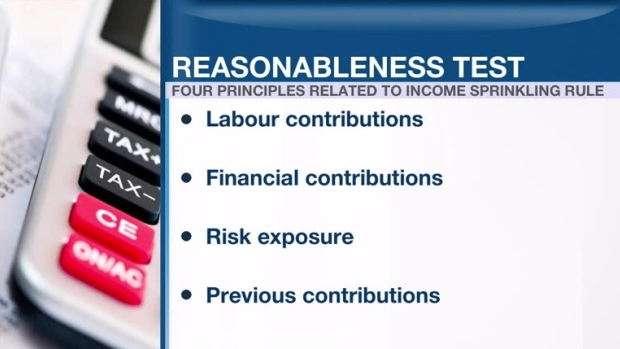

And on Wednesday, Morneau announced long-awaited details about the government’s plan to clamp down on so-called income sprinkling.

However, Canadian Federation of Independent Business President Dan Kelly is already urging Morneau to “adopt the terrific recommendations” made by the Senate Finance Committee and withdraw his entire proposal.