Mar 6, 2020

Set portfolio to perma-crisis as coronavirus fear infects markets

By Dale Jackson

Even the most meticulous retirement planner is having their faith tested as fear over the economic fallout from COVID-19 takes financial markets on a stomach-churning ride.

Markets hate uncertainty and where this all is heading is about as uncertain as it gets. We don’t know how far the virus has spread, how to contain or treat it, the economic fallout, or how the often fickle stock markets will react from here.

Yet, the trend-setting U.S. central bank took a shot in the dark with both barrels this week slashing its benchmark rate by 50 basis points. Other central banks, including Canada’s, followed.

Interest rates are already at rock-bottom going back to the 2008 financial crisis, and bullets are scarce. We will never know if this week’s central bank moves are overkill, which provides great cover for an opportunistic U.S. administration bent on cheap money as fuel for the get-rich-quick crowd, and to manipulate stock markets in an election year. Even before the outbreak, U.S. President Donald Trump repeatedly took the unprecedented step of publicly pressuring the normally non-partisan Fed to lower rates, and has called for further cuts before gauging the impact of the current cut.

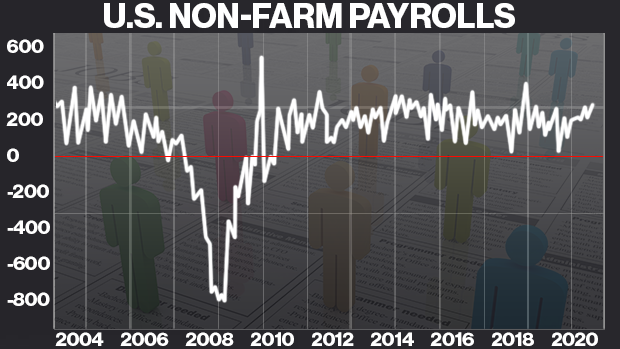

As the coronavirus plays out and the November U.S. election draws closer, long-term investors will need to sift through a campaign of misinformation aimed at conflating the stock market with the economy, and maintaining the myth that the economy has been booming for the past three years despite U.S. GDP and job growth data that show a long and steady recovery since 2009.

It’s impossible to know if the Bank of Canada rate cut was meant to appease the U.S. Fed – and our domestic get-rich-quick crowd – but it’s a further assault on regular Canadian retirement savers looking for security in fixed-income and content with modest gains from equity markets.

Given the uncertainty, the only logical course of action for long-term investors is to hunker down, remain engaged and shut out the noise. If your portfolio was unprepared for this most recent shock you can’t turn back time, but you can prepare for the next one and the one after that.

If you have strived to hold the best companies in a diversified portfolio that spans sectors and geographic regions take note of how their performances compare with their peers. Chances are they will recover more quickly when markets regain their losses as they did in the aftermath of the 2008 meltdown – or just about any correction since. It’s often those same companies that pay dividends that add to an income stream regardless of stock market conditions.

If you have the cash, consider adding to current positions.

If you’re lamenting lower yields from the fixed-income portion of your portfolio, you might feel better knowing it is currently the best performing asset class. A two-per-cent annual yield from a guaranteed investment certificate (GIC) beats a stock market loss.

If you don’t have a qualified advisor, consider getting one. They tend to prove their worth in times like these when our deepest insecurities are tapped.

If you have not heard from your advisor yet, they are not really advisors. They are probably people who sell mutual funds. Keep in mind a portion of the money you invest in mutual funds goes to those people for “ongoing advice,” whether you agree or not.

Most real advisors have already been in touch with their clients through a regular note or individually. Much of what it says should explain solid facts about what is happening and give assurances that your portfolio was built to withstand such events. If you need further assurances, give them a call.

Payback Time is a weekly column by personal finance columnist Dale Jackson about how to prepare your finances for retirement. Have a question you want answered? Email dalejackson.paybacktime@gmail.com.