Jan 14, 2020

Shale Discipline Seen Curbing U.S. Oil Output Growth by Over 50%

, Bloomberg News

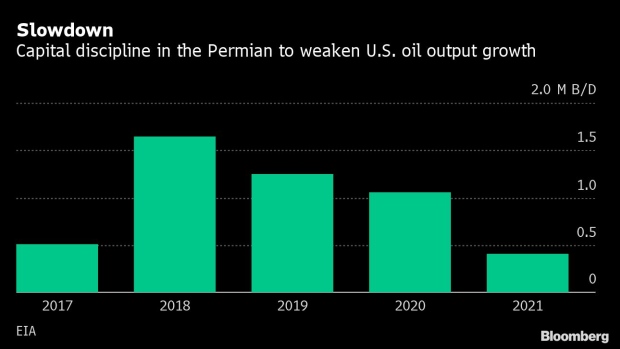

(Bloomberg) -- U.S. oil output growth could decelerate by more than 50% next year as greater capital discipline cuts drilling rigs in America’s largest shale patch.

Production is set to expand by 400,000 barrels a day, the weakest growth since at least 2017, according to the U.S. Energy Information Administration. Output is seen increasing by a little over 1 million barrels a day this year.

The slowdown will be driven by austerity in the Permian Basin, America’s shale-oil engine. That’s after shares of producers were hammered for unbridled output coming at the expense of investor returns. The heads of companies including Pioneer Natural Resources Co. and Centennial Resource Development Inc. have warned of a downturn.

The EIA isn’t alone is expecting a slowdown in growth. The Paris-based International Energy Agency has issued similar forecasts.

Slower production growth could undermine America’s recent transition to being a net energy exporter. In October, the nation sent more crude and refined products abroad than it imported, marking the second consecutive month it was a net petroleum exporter.

To contact the reporter on this story: Sheela Tobben in New York at vtobben@bloomberg.net

To contact the editors responsible for this story: David Marino at dmarino4@bloomberg.net, Pratish Narayanan, Christine Buurma

©2020 Bloomberg L.P.