Jun 22, 2021

Shale’s 400% Rise in Frack Crews Not Enough to Boost Output

, Bloomberg News

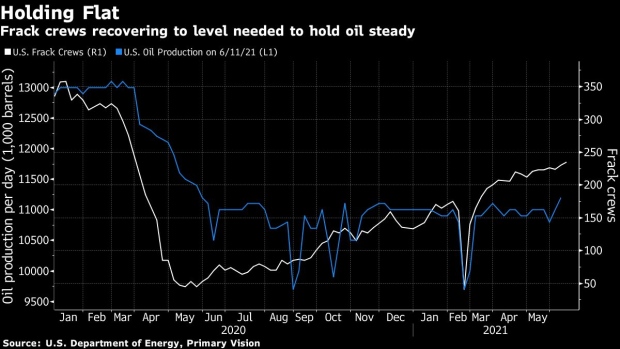

(Bloomberg) -- Even a more than 400% jump in the number of fracking crews working the U.S. shale patch isn’t enough to send oil output soaring. In fact, it’s just enough to keep production relatively flat this year, according to Primary Vision Inc., which has tracked data on frack crews since 2013.

After an 85% tumble in the number of crews completing wells during the depths of the pandemic, the figure has steadily recovered over the past year. It now stands at 235, up from 45 on May 22, 2020. That could grow by roughly another 6% to 250 crews by year end, Scott Levine, an analyst at Bloomberg Intelligence, wrote last week in a report.

But because of the way well production decreases over time, the jump in crews is only enough to keep output flat, rather than boosting it.

“Operators are still focusing on getting out of 2021 with a little bit better managed expectations and better hedge profile,” Matt Johnson, chief executive officer of Primary Vision, said Tuesday in a joint webcast with Bloomberg Intelligence forecasting the pressure-pumping market. “Where is that relative to the actual production? We’re pretty close to managing it at this point.”

Because shale wells see steep declines early in their life of production, the U.S. oil market requires more wells to be drilled and completed in order to replace them and hold output constant. After dramatically turning off activity last year due to history’s worst crude crash, the oil service companies had to ramp up frack crews in order to get new production back online. The mantra among shale’s biggest explorers is to keep output relatively flat this year and send profits back to shareholders.

©2021 Bloomberg L.P.