(Bloomberg) -- China Evergrande Group shares gained early Friday after it avoided what would have been its first default on a public onshore bond.

The stock opened up 1.9% following three days of declines, its longest losing streak in nearly a month. An Evergrande unit said it got investor backing to delay early repayment of a 4.5 billion yuan ($707 million) note.

Country Garden Holdings Co. was reportedly unable to find demand for a $300 million convertible bond. Dwindling investor confidence in China’s largest developer was reflected in its share price Thursday, dropping the most in our months, while its dollar bonds also slid.

Sunac China Holdings Ltd. said late Thursday its $580 million share sale was a precautionary move and that it had no plans to raise more funds in the equity market in the near future. China’s third-largest builder sold shares at a 15% discount to help it repay some loans.

Key Developments:

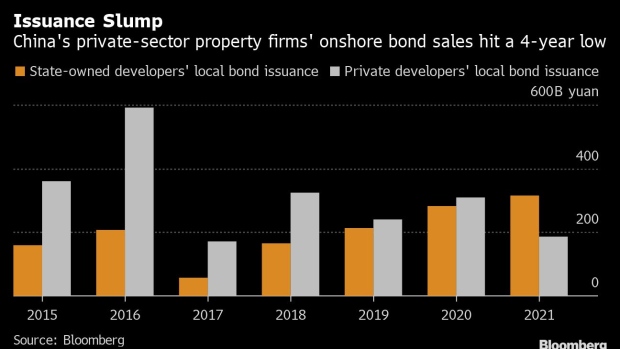

- China’s Property Market Is Set for State-Dominated ‘Age of Rust’

- DaFa Properties Says $144.1m of 2022 Notes Validly Tendered

- Sunac: Total Cash at RMB160b, Can ‘Fully Meet Debt Obligations’

- Evergrande Unit Gets Investors to Back Yuan Bond Payment Delay

DaFa Properties Says $144.1m of 2022 Notes Validly Tendered (6:57 a.m. HK)

DaFa Properties Group Ltd. says $144.1 million of its 9.95% dollar note due Jan. 18, representing around 78% of total outstanding aggregate principal amount, were validly tendered for exchange.

The company decided to waive the minimum acceptance amount condition to its exchange offer, it said in a statement to the Hong Kong stock exchange. It will issue $138.4 million of new notes at 12.5% interest p.a. maturing on June 30.

Sunac Says It Can ‘Fully Meet Debt Obligations (11:30 p.m. HK)

Sunac China said it had total cash of ~160 billion yuan at the end of 2021 and “can fully meet short term debt obligations and project development needs,” according to a company statement.

Evergrande Unit Holders Back Yuan Bond Payment Delay (8:08 p.m. HK)

Bondholders of more than half of the note’s 4.5 billion yuan principal agreed to a proposed payment extension, the developer’s Hengda Real Estate Group Co. unit said in a Shenzhen stock exchange filing. The firm had a Jan. 8 deadline to meet investor demands for early repayment before seeking a delay last week, and a vote on the extension offer had been extended to Thursday.

Shanghai Shimao Wires Funds for Bonds Repayment (5:40 p.m. HK)

Shanghai Shimao Co. has wired funds to repay principal and interest for 1.9 billion yuan of bonds due Jan. 15, according to a statement to Shanghai stock exchange.

©2022 Bloomberg L.P.