May 25, 2022

Shockwaves From Russia’s Aggression Spread Further Through Global Oil Markets

, Bloomberg News

(Bloomberg) -- The shockwaves from Russia’s invasion of Ukraine are spreading ever further through global oil markets.

European refiners have been shunning cargoes of Russia’s Urals grade, a crude variety useful for making gasoline, diesel and jet fuel yet cheapened by its content of corrosive sulfur. With similar blends in short supply, they’re being forced to chase higher quality crude -- the industry’s most prized barrels, known as light sweet.

But output of these blends is also under pressure, triggering a furious contest for premium crudes from Azerbaijan to Malaysia.

“Europe’s main task is to replace Urals from somewhere,” said Viktor Katona, an analyst at energy analytics firm Kpler in Vienna. “Where could Europe get hold of anything akin to Urals? We’re starting to realize the answer is nowhere. But people still need to buy something – margins are insanely good. So people buy light-sweet.”

The intensifying competition couldn’t come at a worse moment.

Oil prices near $110 a barrel are already inflicting pain on motorists, fanning the inflationary pressure that’s threatening to tip the global economy into recession, and could surge further when the US summer driving season arrives. For Europe, the discomfort could become even more acute, as governments mull a full ban on oil imports from Russia in protest over its aggression.

Imperfect Match

To substitute Russia’s ‘medium sour’ variety, refiners would most logically turn to blends from the Middle East. But even these aren’t a perfect match, and availability of them is restricted because the OPEC nations of the Persian Gulf sell mostly on long-term contracts, and are intent on cautiously drip-feeding supplies into the market.

As a result, European operators have switched to lower-density, low sulfur varieties. Yet supplies of these in the surrounding region have become scarce, with Libya plagued by recurrent disruptions and North Sea oilfields poised for maintenance.

As a result, price differentials forthese high quality consignments -- often relative to the global physical benchmark Dated Brent -- are flaring around the world.

Azeri Light, a grade predominantly used by European refiners, is now traded at premiums of $7.50-$8.50 a barrel more than Dated Brent, a level not seen for years, according to traders.

In Asia, Malaysia’s state oil company Petroliam Nasional Bhd, also known as Petronas, managed to sell a cargo of light-sweet Labuan crude at around Dated Brent plus $12 a barrel, which is the highest level that’s been spotted in recent years, according to traders.

Abu Dhabi’s Murban crude, a variety that can produce more diesel and gasoline, also traded at least $2 a barrel higher -- or $1 million more for a cargo -- compared to last month.

CPC Blend, a light grade but somewhat high for sulfur, recently traded at about $2-$3 a barrel below Dated Brent. It was at about a $6 discount in early May. Most CPC cargoes were sold out in about a week after the program was released. Normally it takes two to three.

The discount on U.S. sweet crude benchmark West Texas Intermediate narrowed to $2.07 a barrel to Brent this month, the smallest spread in six months.

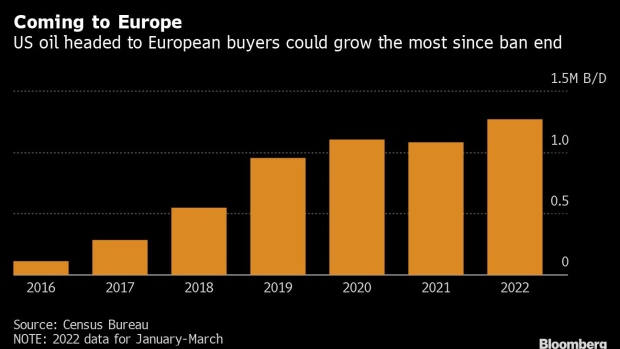

In East Canada, exports of light, sweet Newfoundland crudes to Europe could surpass at least a two-year high this month, according to ship tracking data compiled by Bloomberg. Those grades are typically priced relative to Brent and would normally go to the US.

Traders said that high natural gas prices in Europe are a critical part of the push for the region’s refineries clamoring for light-sweet barrels that take less energy to process. The cost of hydrogen that the plants use is linked to the price of natural gas.

Fuel Markets

The disruption to Russian flows hasn’t been confined to its crude supplies.

The attack has pushed up the cost of diesel in Europe, for whom Russia has long been the key external supplier. Gasoline is fetching record profits too, in part because of concern about the supply of what are called secondary feedstocks -- part-processed oil that then helps to make other fuels. Russia has long been a large supplier of those as well.

And the invasion of Ukraine caused natural gas prices to spike, driving up the cost of hydrogen that refineries need for processing heavier grades.

“Distillate and gasoline inventories are low at present, and demand for both is expected to rise into summer,” said Giovanni Staunovo, commodity analyst at UBS Group AG’s global wealth-management unit. “Due to the high yields of gasoline and distillates, light sweets crude are very attractive for refineries at the moment, resulting in higher prices compared to other crude qualities.”

©2022 Bloomberg L.P.