Oct 4, 2021

Shopify’s bear rout barely dents oil-rich TSX Composite

, Bloomberg News

Stan Wong discusses Shopify

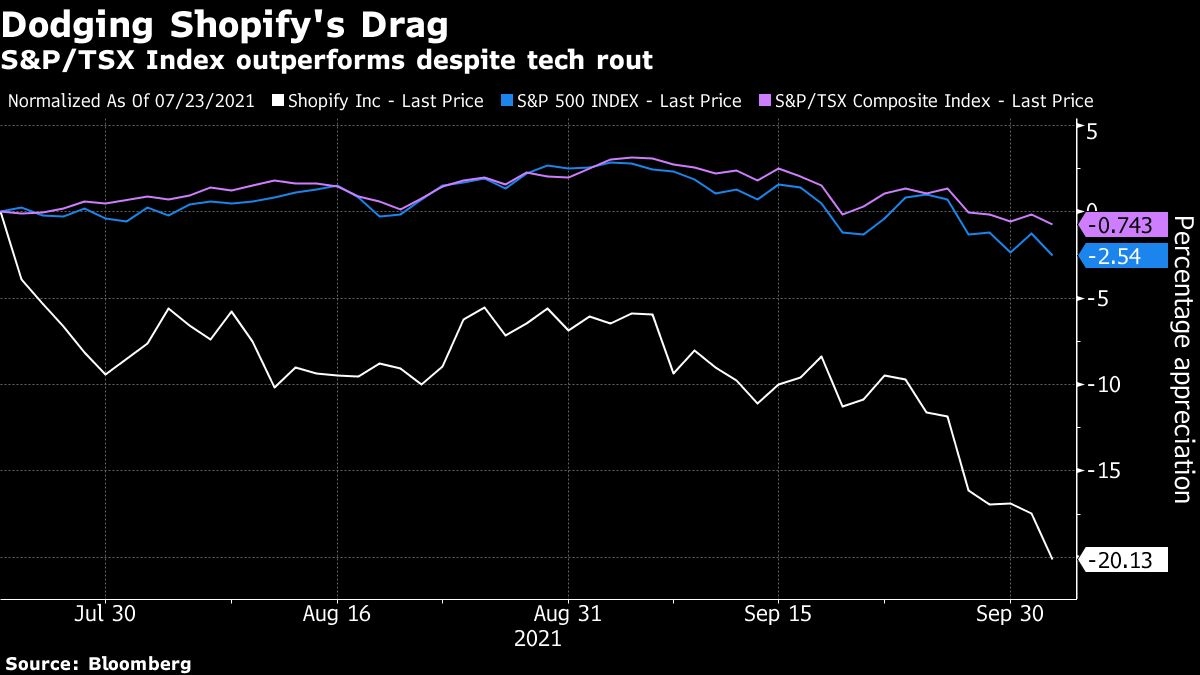

Shopify Inc., the biggest company in Canada’s S&P/TSX Composite Index, is officially in bear-market terrain, down 20 per cent from its record close of $2068.45 on July 23.

But the Canadian index is barely in the red at all during that span and has outperformed the S&P 500 by almost 2 percentage points. One reason is the stunning recovery in Canadian oil sands stocks, which are enjoying the benefits of the highest global oil prices since 2014, as natural gas shortages around the world boost demand for crude.

While Shopify is Canada’s most valuable publicly-traded company, the country’s information technology sector is still smaller than energy in the weightings of the S&P/TSX index.