Aug 1, 2019

Shopify surges to record after boosting outlook on new offerings

, Bloomberg News

Shopify looks to Amazon model as growth slows

Shopify Inc. (SHOP.TO) shares notched another record after the Canadian e-commerce company reported second-quarter sales that beat analysts’ average estimate and gave a more optimistic full-year outlook.

Revenue grew 48 per cent to US$362 million, according to a company statement Thursday. Analysts were projecting US$350.5 million. Shopify raised its 2019 revenue guidance to a range of US$1.51 billion to US$1.53 billion but kept its outlook for adjusted operating income of US$20 million to US$30 million unchanged.

The stock climbed as much as 10 per cent to a record US$350 in New York at 10:30 a.m.

“Our strong performance in the second quarter reflects the success of our ongoing activities and investments to help merchants start selling, sell more, and sell globally,” said Chief Financial Officer Amy Shapero.

Shopify, Canada’s biggest technology company by market value, has been a darling among investors who have rewarded the company’s fast-growing sales and recent innovations in online checkout products. The stock has more than doubled this year, outpacing the S&P 500 and the S&P/TSX Composite Index and has been trading recently near record levels. But the rally has also made it a target for shortsellers, who have shorted nearly 5 per cent of the stock.

In addition to helping companies with online sales, Shopify now also offers services that compete with companies like Square Inc. at the point-of-sale in brick-and-mortar stores. In the second quarter, Shopify introduced new services such as 3D modeling for product listings and multilingual, multicurrency checkout options, as well as an upgraded point-of-sale system.

“The three opportunities for sustained growth that can enable the stock to grow into its valuation are international expansion, fulfillment and retail point-of-sale,” said Tom Forte, senior research analyst at DA Davidson & Co. “These will have more impact on future operating performance than on the June quarter.”

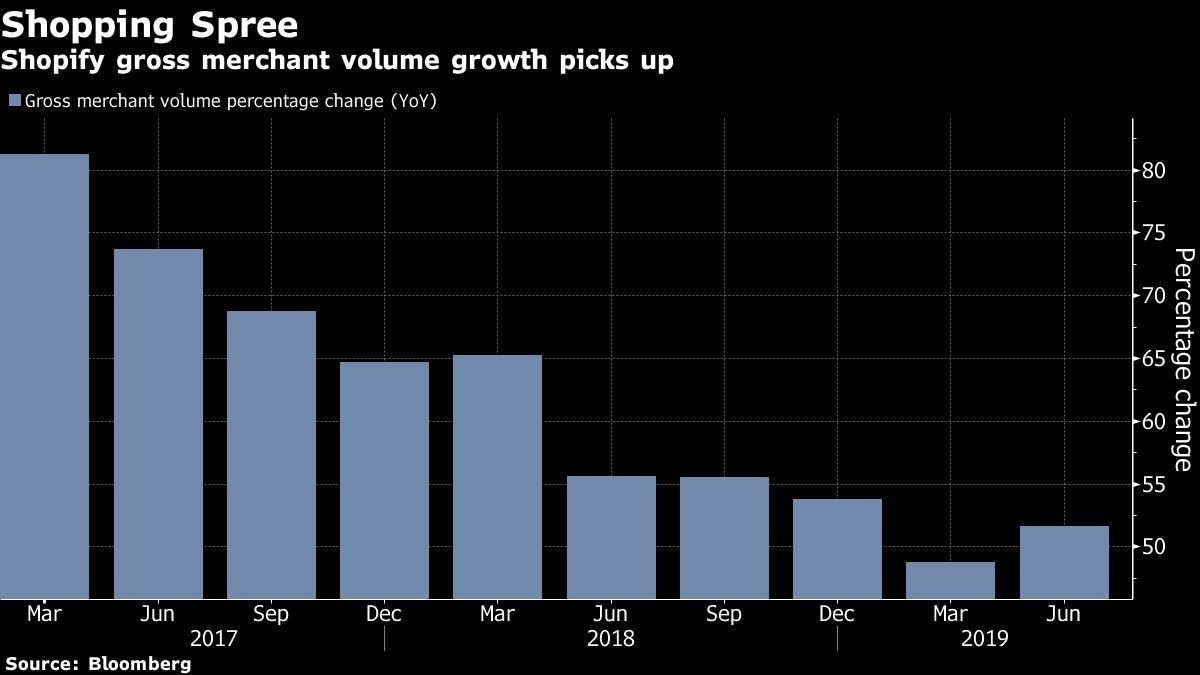

Gross merchandise volume, a key metric for e-commerce companies, increased 51 per cent to US$13.8 billion in the second quarter. Adjusted earnings per share were 14 cents, compared with the average analyst forecast of 3 cents. Shopify has yet to turn a profit on a GAAP basis and isn’t projected to until the end of 2020, according to analyst estimates.

And, while still notching high growth rates in sales, the 48 per cent increase in the second quarter was the slowest in Shopify’s four years as a listed company. To counter this slowdown, the company has been focusing on scaling up. In June, Shopify said that it would spend US$1 billion to create a network of fulfillment centers in the US, positioning itself as a smaller rival to Amazon’s fulfillment service.

“No other company is as well-positioned as Shopify to offer this by leveraging our scale with machine learning and demand forecasting, smart inventory allocation across warehouses and intelligent order routing,” Harley Finkelstein, Shopify’s chief operating officer, said on an analyst call.

Finkelstein added the company’s new POS system was “faster, more intuitive and more scalable, allowing retailers to expand their brick-and-mortar business.”

While Shopify has said that it would be able to offset the cost of setting up a logistics network with the additional revenue the service would generate, some analysts are speculating that another share offering may be on the horizon.

--With assistance from Karen Lin