Mar 24, 2023

Short-End US Rates Plunge as Wild Moves Grip Market for 11th Day

, Bloomberg News

(Bloomberg) -- Markets are signaling the Federal Reserve is wrong when it talks about the prospect for further interest-rate hikes, with bond investor Jeffrey Gundlach among the latest to predict cuts instead as the risk of recession grows.

Yields on shorter-maturity bonds from Treasuries to bunds and Australian debt have slumped over the past two weeks as investors pessimistic about the economic outlook cemented their view that the Fed will need to cut interest rates later this year. That’s reverberating across the globe as traders position for the end of tightening cycles.

Swap markets are suggesting the Fed is probably done with its current cycle of rate increases, with the chances of a quarter-point hike in May falling to just one-in-three. The market is also pricing for at least three quarters of a point of easing by year-end, despite Fed Chair Jerome Powell’s insistence Wednesday that officials don’t anticipate cutting rates.

Gundlach, DoubleLine Capital LP’s chief investment officer, sees the Fed cutting rates “substantially” soon, according to posts on Twitter. He also warned of “red alert recession signals” emanating from the US yield curve.

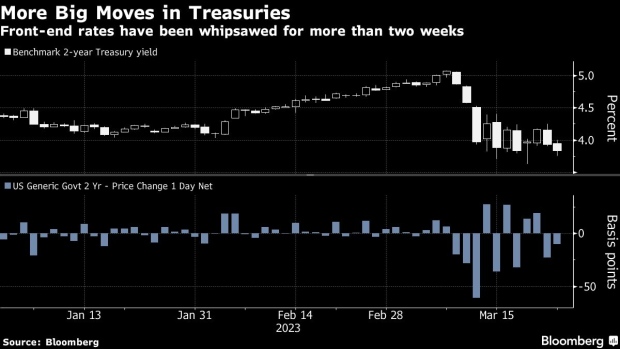

The two-year Treasury yield fell as much as 18 basis points on Thursday to 3.75%, having earlier been up close to 7 basis points, marking an 11th straight session with an intraday range of more than 20 basis points.

It started Friday with fresh declines, before erasing that move to trade little changed around 3.80%. It has now dropped almost a percentage point in March to head for the steepest one-month decline since 1987.

Part of the reason for soaring volatility is that bonds are coming off a bruising February when yields surged as the Fed led global central banks in a push back against bets on policy pivots.

Traders have regularly underestimated the size of the Fed’s hikes. They first started anticipating a policy pivot in the middle of last year — betting the central bank’s rate would be lower in a year’s time than they expected it to be in six months — but so far all those wagers have proved fruitless.

“Investors are seeking safe-haven yields over fears of banking stresses and tighter financial conditions, worries about the commercial real estate industry and a general view that the Fed — and BOE today — have taken policy rates too deep into restrictive territory, for now,” said William O’Donnell, US rates strategist at Citigroup Global Markets.

‘Not Far Away’

The Fed on Wednesday raised rates by a quarter point, its ninth-straight increase, while the Bank of England the following day raised its key rate by a quarter point, an 11th consecutive boost. The European Central Bank is still expected to deliver at least one more hike and likely a second, before calling a halt. Australia’s policymakers are projected to stay on hold next month and then cut as early as August.

“Markets are inclined to think we are at the end of the tightening cycle for the US, despite Powell’s remarks that rate cuts are not in the cards yet,” Societe Generale analysts led by head of US interest rates strategy Subadra Rajappa wrote in a note.

When it comes to Europe, “the latest FOMC meeting seems to have convinced that a pivot is not far away,” they said.

Read More: Wall Street Is Making Same Fed Bet That’s Burned It Repeatedly

German two-year yields slid 18 basis points on Thursday, after climbing by 35 basis points over the previous two days. Australian three-year yields slid just six basis points on Friday.

Investors may find it better to fade European bond rallies as the region’s “central banks have more ground to cover in their fight against inflation,” the SocGen analysts said.

(Adds further Gundlach comments.)

©2023 Bloomberg L.P.