Jun 8, 2020

Short-Sellers Set Their Sights on Surging Asia Biotech Stocks

, Bloomberg News

(Bloomberg) --

Short sellers across Asia are being drawn to the health care sector, betting the region’s best-performing industry this year is poised for a retreat.

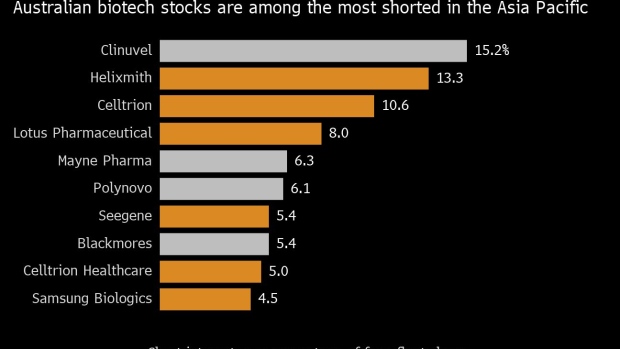

The daily average amount of short interest among 324 biotechnology and pharmaceutical stocks across Asia’s major equity benchmarks has more than doubled so far this year from 2019, according to data compiled by Bloomberg. Australian firms account for almost half of the top 10 most shorted ones as they reset operations and seek to win regulatory approval for products in some of the world’s most lucrative markets.

Rich valuations, regular deadlines and approval hurdles result in increased volatility, making the sector a “breeding ground for short sellers,” said Eleanor Creagh, market strategist at Saxo Capital Markets in Sydney.

Australian drugmaker Clinuvel has the highest amount of short interest at more than 15% of its free-float as demand for growth stocks heightened after the selloff in March. Korean companies such as Helixmith Co. and Celltrion Inc. are attracting bears in a sector where speculation on clinical trials and product usage has thrived amid the coronavirus pandemic.

Investors are betting the Australian firms will decline because they face more uncertainty than most other stocks in the health sector, according to Morningstar Investment Service analyst Nicolette Quinn. Mayne Pharma Group Ltd and Blackmores Ltd. are implementing turnaround strategies, while Clinuvel and Polynovo Ltd. are “early in the ramp-up phase with exponential growth implied in their share prices.”

Those valuations, coupled with sometimes unproven growth, have ushered in higher levels of short interest, Creagh said. The four heavily-shorted Australian firms trade at forward price-to-earnings ratios that are more than twice as high as the benchmark S&P/ASX 200 Index. Polynovo is the most extreme case, trading at 356 times estimated profits for next year.

A lack of analyst coverage may also be one reason why short sellers are gravitating toward Clinuvel, Chief Executive Officer Philippe Wolgen said in a phone interview. The firm doesn’t have any current analyst ratings, according to Bloomberg data.

The binary nature of the sector -- firms either succeed or fail at bringing products to market -- is also a siren song for bears. Those types of scenarios are playing out in Australia, Quinn said, pointing to Mayne Pharma’s effort to get a contraceptive product approved and launched in the U.S.

Asia’s Hottest Stock Sector Is ‘More Than a Defensive Play’

To be sure, most equity markets are heavily shorted at the moment amid a rebound that’s been largely led by health shares, said Kyle Rodda, an analyst at IG Markets Ltd. Health care is one of just two sectors on the MSCI Asia-Pacific Index that are in the green this year, gaining almost three times more than the second-placed communication services grouping.

“We find traders have a strong impulse to trade counter to prevailing trends,” he said. “A still generally skeptical market is attempting to maximize risk-reward by shorting biotech stocks.”

Even so, the euphoria over health stocks may have already withered in Australia. The sector is the worst performer this quarter and is clinging on to positive territory.

©2020 Bloomberg L.P.