Nov 4, 2022

Significant jobs gain likely isn’t enough to change Bank of Canada rate hike strategy: Economists

, BNN Bloomberg

Canada’s labour market adds more jobs than expected

While Canada’s labour market posted a significant jobs gain in October, many economists say it might not be enough to change the Bank of Canada’s rate hike strategy.

Canada’s labour market added 108,000 jobs in October, which significantly surpassed estimates of an increase of 10,000 by economists tracked on the Bloomberg terminal.

But Andrew Grantham, senior economist at CIBC Capital Markets, said he still sees the Bank of Canada hiking interest rates by 50 basis points at its next announcement in December.

“Today's data shouldn't change the narrative that we are closer to the end of the current rate hiking cycle than the beginning, although it does support the call for a 50bp (basis points) hike rather than 25bp in December,” Grantham said in a note to clients Friday.

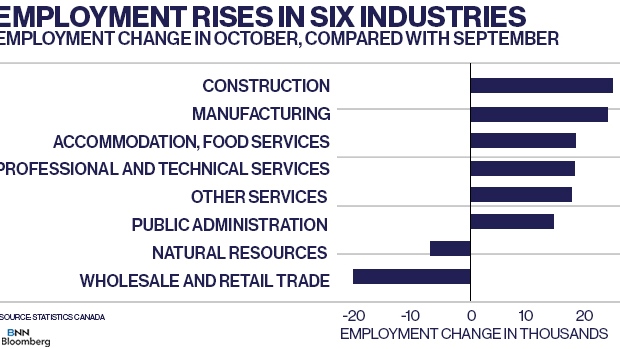

Job gains in October were lead by construction, manufacturing, and accommodation and food services.

Here’s a look at the October employment change across different industries:

- Construction added 24,600 jobs

- Manufacturing gained 23,800 workers

- Accommodation and food services hired 18,300 employees

- Professional, scientific and technical services added 17,900 jobs

- Other services gained 17,500 workers

- Public administration hired 14,500 employees

- Natural resources lost 6,800 positions

- Wholesale and retail trade saw employment decline by 20,200 workers

WAGE GROWTH ACCELERATES

In a note to clients on Friday, Douglas Porter, chief economist at BMO Capital Markets, said the Bank of Canada will “cast a wary eye on the renewed upswing in wages.”

In October, average hourly wages rose 5.6 per cent compared to a year ago, which was higher than the 5.2 per cent reported in September.

This marked the fifth consecutive month that average hourly wages remained above five per cent.

Stephen Brown, senior Canada economist with Capital Economics Ltd., said this could be a “worrying development” for the Bank of Canada.

“The strength of employment and wage growth could undermine the Bank’s belief that is has done enough to ensure that CPI inflation returns to target and will therefore increase speculation that the Bank will have to enact another 50 bp hike in December, rather than drop down to a 25 bp hike as it has hinted – although we have the November LFS (Labour Force Survey), and the October CPI (Consumer Price Index) report, to come before that meeting,” Brown said in a note to clients on Friday.

The last Bank of Canada interest rate announcement for the year will be on Dec. 7.