Mar 8, 2023

Silvergate Short Bets Amass $780 Million Payday as Crypto Bank Sinks

, Bloomberg News

(Bloomberg) -- Short sellers are making a fortune by loading up on bets against struggling crypto-friendly bank Silvergate Capital Corp.

Shares have plunged roughly 98% from a November 2021 peak, earning bearish bettors about $780 million in mark-to-market profits in the process, including more than $190 million last week alone as questions about Silvergate’s viability surfaced, data from S3 Partners show.

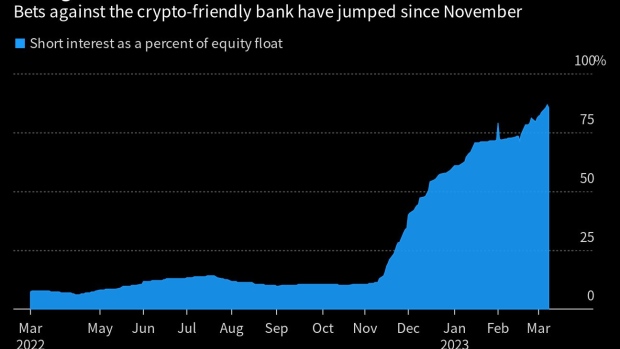

Wagers against the stock surged in recent months as crypto contagion spread across the market and setbacks for the bank accumulated. About 85% of Silvergate’s float is sold short, one of the highest rates among US stocks, S3 data show.

Traders looking to increase short exposure are now hampered by a severe lack of stock available to borrow and rising financing costs, said Ihor Dusaniwsky, the head of predictive analytics at S3.

“The well has run dry,” he said by phone.

Those bets have been paying off as Silvergate’s troubles snowballed. US regulators were sent to the bank’s headquarters as the firm tries to stay in business, Bloomberg News reported Tuesday, citing people familiar. Meanwhile, Wall Street analysts piled on to downgrade the stock after its crypto payments network was shuttered.

Investors are also using put options to bet against Silvergate. George Soros’s family office revealed a bet against the La Jolla, California-based company last month.

Cryptocurrency-related stocks, including Silvergate, thrived as Bitcoin prices surged during the token’s 2021 heyday. The collapse of crypto exchange FTX rattled confidence across the space in November. In January Silvergate shares plunged after the bank posted a loss and cut jobs.

The stock sank 5.8% on Wednesday to close at $4.91, a record low.

(Updates with closing price in final paragraph.)

©2023 Bloomberg L.P.