Nov 6, 2022

Singapore and Thai Currencies Most at Risk From Yuan’s Slump

, Bloomberg News

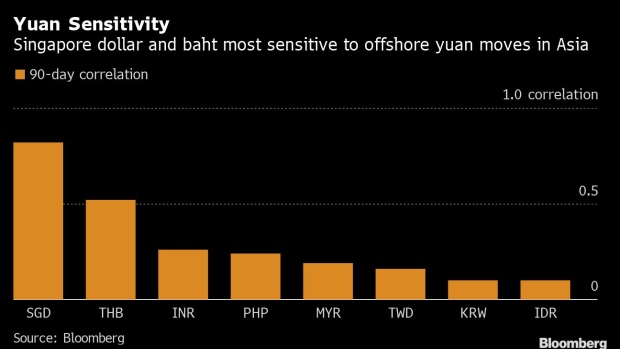

(Bloomberg) -- Investors in the Singapore dollar and Thai baht will have to brace for losses if the Chinese yuan, the worst-performing Asian currency on Monday, continues its fall against the dollar as the country sticks to Covid zero approach.

Both currencies have the highest 3-month daily correlation with the offshore Chinese yuan in emerging Asia, signaling a further drag from extended weakness in the Chinese currency. The People’s Bank of China’s move on Monday to end its string of stronger-than-expected yuan fixings that had been in place since August has traders betting that Beijing is reducing its support for its currency.

READ: China-Linked Currencies Slide as Beijing Sticks With Covid Zero

Onshore and offshore yuan fell the most among peers in Asia after Chinese health officials over the weekend vowed to “unswervingly” stick to a Covid Zero approach. Singapore’s open and export-oriented economy will be impacted by a slowdown in the Chinese economy, while the lack of Chinese tourists will weigh on the baht, as they contributed around 20% to its economy pre-pandemic.

--With assistance from Masaki Kondo.

©2022 Bloomberg L.P.