Aug 15, 2022

Singapore Court Grants Zipmex Three-Month Creditor Protection

, Bloomberg News

(Bloomberg) -- Asia cryptocurrency exchange Zipmex Pte was granted more than three months of protection from creditors by Singapore’s High Court, giving the troubled firm breathing room to come up with a funding plan.

Justice Aedit Abdullah gave each of the five Zipmex entities a moratorium until Dec. 2. That will shield the companies from potential creditor lawsuits. The firm operates out of Singapore, Thailand, Indonesia and Australia and was seeking a five-month protection from creditors to form a restructuring plan.

The trading platform ran into a cash crunch after its exposure to crypto lender Babel Finance soured. Zipmex recently allowed partial withdrawals after shutting them down late last month.

Zipmex’s moratorium comes after a decision earlier this month by Justice Abdullah to grant the parent company of Vauld, another crypto firm with local operations, a three-month protection from creditors.

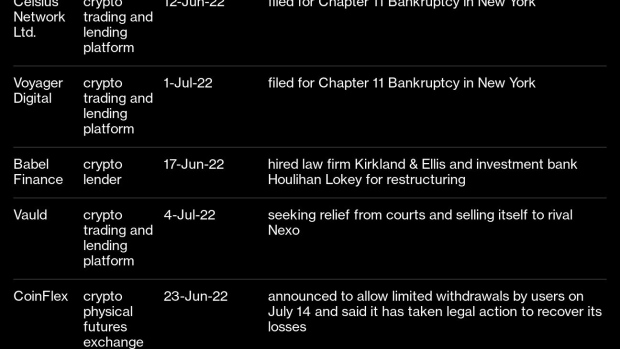

Vauld, a distressed crypto lender, announced in July that it was freezing withdrawals, adding to a series of high-profile crypto collapses. Hodlnaut, another crypto lender with Singapore operations, has also halted withdrawals.

A slew of digital-asset companies worldwide have been hit by a rout in the crypto sector this year that’s only just begun to stabilize.

Crypto lending -- where promises of yields above 10% weren’t uncommon -- came under strain after the TerraUSD stablecoin collapsed and the Three Arrows Capital hedge fund unraveled.

In Zipmex’s case, the judge said a creditors committee needs to be engaged, and a town hall for creditors should be held.

Zipmex has so far received initial interest for funding from a few investors and due diligence is ongoing, it said early this month. In Singapore, Zipmex holds an exempted payment service provider permit, rather than a full license under the central bank’s new regime for crypto asset firms.

(Updates with comment from judge in penultimate paragraph.)

©2022 Bloomberg L.P.