Feb 8, 2023

Singapore Wins Record $17 Billion Investment Pledge on Reopening

, Bloomberg News

(Bloomberg) -- Singapore said it secured record investment commitments last year as the economy reopened, while warning that officials don’t expect to repeat that performance amid mounting global headwinds.

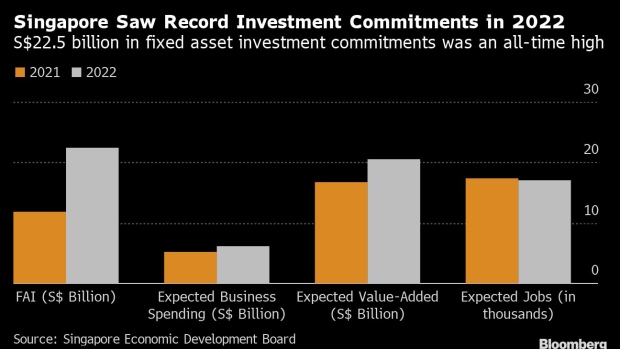

The city-state attracted S$22.5 billion ($17 billion) in fixed-asset investment commitments in 2022, nearly double the S$11.8 billion level the previous year, according to data released Thursday by the Economic Development Board. The inflows were driven by the electronics sector, which cornered two-thirds of the investment pledges.

“We don’t expect these sorts of numbers going forward,” EDB Chairman Beh Swan Gin said at a briefing. He cited three main headwinds: the high cost of capital due to higher interest rates, “aggressive” policies elsewhere to attract investments, and decarbonization efforts that “will require us to be more selective” about energy-intensive projects welcomed in Singapore.

The International Monetary Fund forecasts the global economy will expand 2.9% this year, slower than the 3.4% pace of 2022 amid restrictive monetary policies crimping demand. That is tempering Singapore’s expectations for investment flows, with FAI commitments seen in a range of S$8 billion-S$10 billion in the medium- to long-term.

Officials for the investment-promoting arm of Southeast Asia’s financial hub said they were realistic about the competition for slimmer international investment this year.

Still, the EDB chairman touted the city-state’s evergreen attractiveness, thanks to what he called its track record of “stability and trust.” That reputation, he said, was reinforced by Singapore’s deft handling of the Covid crisis.

More highlights from the EDB’s presentation:

- In the semiconductors industry, EDB sees continued success for Singapore in attracting mature nodes and wafer fabs, in addition to design-related chips jobs that are growing steadily, said Beh

- Asked about technology companies’ recent headline-grabbing firings, EDB Managing Director Jacqueline Poh said there is a “moderation” in hiring for tech jobs due to waning global demand and also aggressive hiring earlier, “but long-term demand for tech skills in Singapore remains robust”

- A jump in private equity, venture capital, and family offices in Singapore over the past decade allows the city state a healthy pool of private capital to leverage for leading global businesses setting up shop here, said Poh

- Asked on the OECD-led 2021 agreement on a global minimum corporate tax, Beh said Singapore welcomed the deal “because it does prevent a race to the bottom” on levies

- He said the challenge now on that tax deal is to ensure that enforcement is a level-playing field, and that while it’s an open question how multinational companies respond, he feels good about Singapore’s other advantages attracting companies to its shores

(Updates with more details in bullets)

©2023 Bloomberg L.P.