Feb 22, 2018

Snap CEO got US$638M in 2017 thanks to IPO stock grant

, Bloomberg News

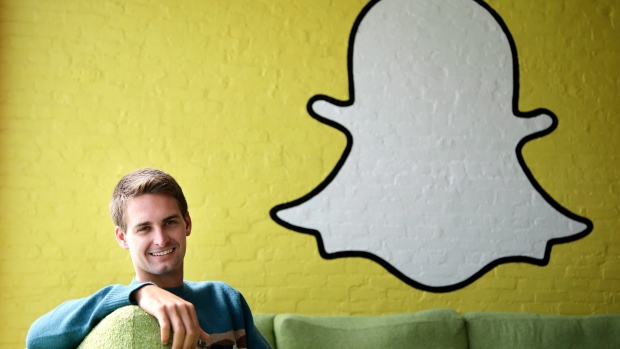

Snap Inc.’s Chief Executive Officer Evan Spiegel is poised to become one of the highest-paid U.S. executives for 2017, thanks to a US$636.6 million stock grant he got when his company went public.

The Venice, California-based maker of the Snapchat photo-sharing app awarded Spiegel shares equal to 3 per cent of the outstanding capital stock when the initial public offering closed in March, according to the firm’s annual report filed Thursday. He’ll receive the shares in increments through 2020.

Snap has had a volatile first year as a publicly traded company. Executives overseeing product, engineering and sales have departed. Facebook Inc. has copied some of its most popular features for bigger audiences and Twitter Inc. is said to be working on a new Snapchat-style product.

Scores of users including Kylie Jenner have criticized the recent update of the app. The stock fell as much as 7.2 per cent on Thursday after Jenner tweeted to her 24.5 million followers, “sooo does anyone else not open Snapchat anymore? Or is it just me...ugh this is so sad.” The stock also has lagged the S&P 500 Information Technology Index in the past 12 months.

Spiegel, 27, also received about US$1.08 million in company-paid perks including legal fees and US$561,892 for personal security services. His salary was cut from US$500,000 to US$1 around the time of the IPO.

Chief Strategy Officer Imran Khan received US$100.6 million in compensation last year. That includes a grant of stock worth US$100.1 million that will be fully vested within about a decade regardless of the firm’s performance.

Both Spiegel’s and Khan’s grants were one-time awards, according to the filing. Companies often grant large blocks of equity to executives when they go public, saying such awards are necessary to keep them on the job.

Spiegel last week sold about US$50 million of stock, his first disposal since the firm went public. The company’s executives and directors have sold about US$160 million worth of shares since the IPO, according to data compiled by Bloomberg. Some of those transactions have been made solely to cover taxes on shares that vested.