May 17, 2019

SNC Cancels 407 Sale to OMERS as Canada Pension Plan Seeks Slice

, Bloomberg News

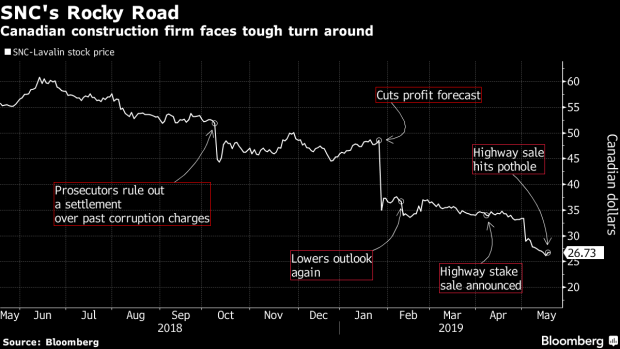

(Bloomberg) -- SNC-Lavalin Group Inc.’s attempt to sell a stake in a Toronto toll road is bumping into legal headaches, though the embattled construction firm says the transaction is still on track to proceed.

SNC terminated a deal to sell a 10% stake in 407 International Inc., the 108-kilometer (67-mile) highway north of Toronto, to the OMERS pension fund for C$3 billion ($2.22 billion) in cash, the Montreal-based engineering firm said in a statement Friday. The move, which is subject to a later payment of a break fee of about C$81.3 million, comes after Canada Pension Plan Investment Board exercised rights of first refusal on the proposed deal.

Further complicating the matter, another of the toll-road owners, the Cintra Global unit of Ferrovial SA of Spain, wants to by about 52% of the stake SNC is selling. SNC contests it legal ability to do so, and the matter is going to court, with an expedite hearing scheduled June 21.

Cintra holds 43.2% of highway 407, and indirectly owned subsidiaries of CPPIB own about 40%.

While the competing interest may delay the sale, SNC says parties agreed that irrespective of the outcome, it would be permitted to sell the share “as soon as practicable.”

A representative for OMERS declined to comment. Representatives for Cintra and CPPIB didn’t immediately return a request for comment.

The stake sale, announced in April, was part of the loss-making company’s efforts to improve to improve its balance sheet. The company reported an unexpected loss in the first quarter and intensified a cost-cutting program to meet annual targets.

SNC shares were little changed at C$26.81 at 10:02 a.m. in Toronto.

--With assistance from Aoyon Ashraf, Esteban Duarte and Paula Sambo.

To contact the reporters on this story: Sandrine Rastello in Montreal at srastello@bloomberg.net;Doug Alexander in Toronto at dalexander3@bloomberg.net

To contact the editors responsible for this story: Crayton Harrison at tharrison5@bloomberg.net, Jacqueline Thorpe

©2019 Bloomberg L.P.