May 2, 2019

SNC Reports Unexpected Loss, Accelerates Cost Cuts to Hit Target

, Bloomberg News

(Bloomberg) -- Trouble isn’t over yet for embattled Canadian engineering firm SNC-Lavalin Group Inc., which reported an unexpected loss in the first quarter and intensified a cost-cutting program to meet annual targets.

The Montreal-based company at the heart of Canada’s biggest political scandal in years reported an adjusted loss from engineering and construction of 8 cents a share, while analyst expected a 30-cents a share profit. It maintained its outlook for the year.

Key Insights

- SNC says it will focus on its core geographies and move away from countries where it has only “sub-scale’’ operations. It has also stopped bidding for “lump sum’’ mining projects, after the dispute with Chilean copper company Codelco, which in March canceled a contract worth $260 million to build two acids plants.

- Earnings before interest and taxes in the newly formed resources unit will turn positive in 2019, with margins of 4 percent to 6 percent.

- SNC’s sale of a 10 percent stake in a Toronto toll-road to the OMERS pension plan may not be a done deal. SNC said it’s been informed that a Highway 407 ETR shareholder may exercise its right of first refusal. If that happens, SNC will owe OMERS a break fee of 2.5 percent of the purchase price.

- The Cintra Global unit of Ferrovial SA of Spain holds 43.2 percent of highway 407, and subsidiaries of Canada Pension Plan Investment Board own 40 percent.

- The earnings report doesn’t mention SNC’s now famous legal woes, which have been at the center of a controversy that has engulfed Justin Trudeau after his former attorney-general said the Canadian prime minister and some of his aides pressured her to intervene to help the construction firm avoid a trial.

Market Reaction

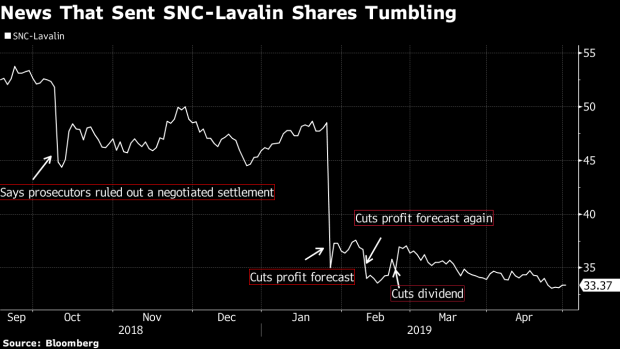

- The stock has fallen 31 percent since Jan. 25, the last trading day before the first of two profit warnings within weeks of each other.

- For more details on the results, click here.

To contact the reporter on this story: Sandrine Rastello in Montreal at srastello@bloomberg.net

To contact the editors responsible for this story: Crayton Harrison at tharrison5@bloomberg.net, David Scanlan

©2019 Bloomberg L.P.