Jan 16, 2022

Soaring Energy Costs to Add Pressure on Indonesia Budget Deficit

, Bloomberg News

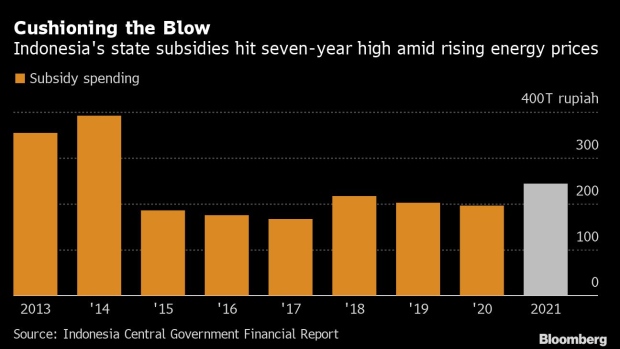

(Bloomberg) -- Indonesia’s subsidy bill, which may balloon beyond its current seven-year high, is forcing the government to seek a balance between fiscal discipline and rising consumer prices.

State subsidies hit 243.1 trillion rupiah ($17 billion) in 2021, surpassing its budget allocation by 39% and marking the highest since 2014, the last year before President Joko Widodo drastically cut back the financial support. This year, the government is setting aside 207 trillion rupiah for subsidies.

The number could go even higher, according to PT Bank Central Asia chief economist David Sumual, who dubs energy costs the “wild card” for Indonesia’s economy. While global commodity prices may not reach the same heights they saw in late 2021, aggregate demand is strengthening due to the economic recovery, he said.

The subsidies -- which cover electricity, diesel and liquefied petroleum gas, among others -- have kept prices well under control in Indonesia even as supply-chain bottlenecks and commodity shortages spurred red-hot inflation elsewhere.

For example, regular-grade gasoline was priced at 6,450 rupiah (45 cents) a liter in 2021. In neighboring Philippines, the retail pump price of similar-octane fuel was more than double that at 58 pesos ($1.13).

Even The World’s Top Palm Oil Producer Is Worried About Prices

It’s a delicate balancing act between fiscal prudence and price stability. The government seeks to meet its pledge of returning the budget deficit within the legal limit of 3% of gross domestic product next year, all while keeping an eye on inflation that’s set to accelerate this year as people ramp up spending in the economic reopening.

Indonesia may have to cut subsidies eventually as it focuses on the budget promise, said ING Groep NV senior economist Nicholas Mapa. A modest increase will “allow inflation to rise slightly while still ensuring the deficit continues to dip,” he added. “They can balance the two.”

A revenue windfall kept last year’s budget deficit at 4.65% of GDP, below an earlier estimate of above-5%. The government says it can take significant strides to cut this further to 4.1% of GDP this year.

BCA’s Sumual estimates that every 10% increase in fuel prices would add about 0.2-0.3 percentage points to inflation. While the rate has remained below the central bank’s 2%-4% target, Finance Minister Sri Mulyani Indrawati has sounded her caution and called for officials to be especially vigilant of commodity and food prices this year.

©2022 Bloomberg L.P.