May 29, 2020

Societe Generale Starts Strategy Review After Equities Losses

, Bloomberg News

(Bloomberg) -- Societe Generale SA’s top governance body has pushed for a strategic review of the bank’s businesses after it sustained heavy losses in its once-vaunted equities trading unit.

The move reflects the board’s dissatisfaction with recent troubles at the equities division, which was at the heart of the bank’s surprise first-quarter loss, according to people familiar with the matter. The review of how each business unit’s performance in the coronavirus crisis has changed its profitability outlook goes beyond the bank’s regular strategy assessments, the people said, asking not to be identified because the discussions are private.

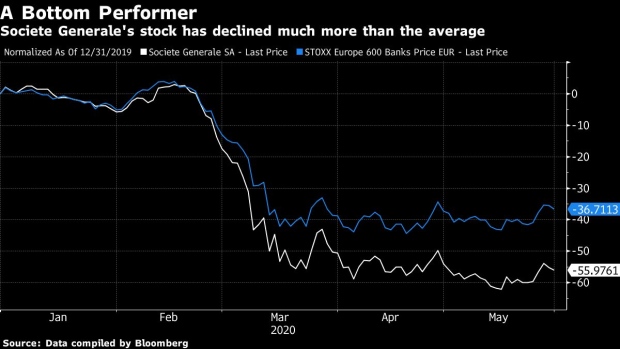

Chief Executive Officer Frederic Oudea, the longest-serving leader of a top European bank, said after the first-quarter results that SocGen was going to accelerate a transition toward simpler products. But the board-led review suggests pressure is building on the CEO, as shares of the Paris-based lender have slumped 56% this year, one of the worst-performing European bank stocks in that period.

The review started about two weeks ago and is slated to last through June, the people said. Complex products will probably be cut back in favor of simpler equity derivatives, the people said. The unit is known for dealing in structured products, lucrative but highly complex derivatives that caused heavy losses when markets went against the bank in the first quarter.

A spokesperson for SocGen declined to comment on the review.

SocGen late last year initiated a formal search for a successor to Oudea, Bloomberg has reported. The plan then was to have a candidate ready when the CEO’s term ends in 2023, though the replacement could happen before that, people familiar with the matter said at the time.

Oudea has been in charge for more than a decade, for a while in the dual role of CEO and chairman of the board of directors. In 2015, SocGen separated the two roles and named former European Central Bank board member Lorenzo Bini Smaghi to oversee the board.

SocGen wasn’t the only French bank to take a hit from equity derivatives in the first quarter, with BNP Paribas SA and Natixis SA also suffering heavy losses in a period when Wall Street banks that trade simpler products did well.

The French firms were hit as their more complex structured products became increasingly difficult to hedge, and they also suffered losses when companies across the globe started to cancel dividends, key components in many of their complicated deals.

©2020 Bloomberg L.P.