Mar 6, 2023

SoFi Bank Sues to Stop Biden’s Student Loan Repayment Pause

, Bloomberg News

(Bloomberg Law) -- SoFi Bank NA is asking a federal court to strike down the Biden Administration’s eighth extension of a moratorium on student loan repayment.

In the alternative, SoFi said, the court should order repayment by borrowers who aren’t eligible for student-debt cancellation under the terms of the Education Department’s debt-forgiveness plan, according to the complaint filed in the US District Court for the District of Columbia March 3.

The moratorium violates the Administrative Procedure Act because the department didn’t identify any statutory authority for the extension, and failed to publish notice of the extension in the Federal Register, SoFi said.

SoFi alleges it has lost between $9 million and $11 million in total revenues and approximately $6 million to $8 million in profits since the most recent extension went into effect in January.

SoFi projects that if the extension continues through August, it will result in $40 million to $45 million in total lost revenues and approximately $25 million to $30 million in total lost profits.

The administration’s student loan forgiveness plan has faced legal challenges since its launch. The US Supreme Court is set to rule on its constitutionality, but must first determine whether the plaintiffs have standing to challenge the measure.

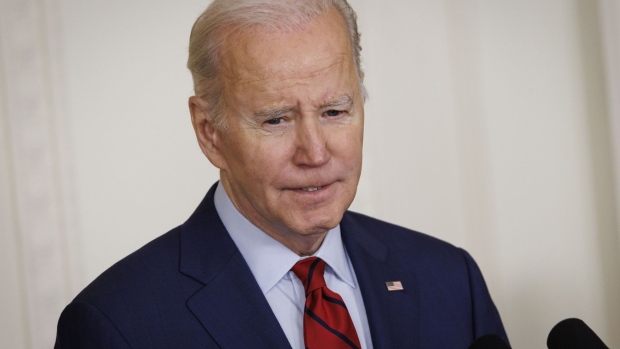

Biden’s student loan relief plan, announced Aug. 24, would forgive up to $20,000 in federal loans for those who also received Pell Grants and a maximum of $10,000 for other borrowers. Only those earning less than $125,000, or $250,000 for married couples, would qualify for the relief.

The plan relies on a 2003 law, called the Higher Education Relief Opportunities for Students Act, to justify pausing student loan payments during the pandemic.

The act allows the Department of Education to waive federal student loan requirements to support borrowers in an emergency, such as a natural disaster or war. Congress passed the law to help borrowers serving in the military after the Sept. 11 attacks. Biden said in August that the Covid-19 pandemic is such an emergency, even as deaths have fallen.

The department didn’t immediately respond to a request for comment.

Arnold & Porter Kaye Scholer LLP represents SoFi.

The case is SoFi Bank N.A. v. Cardona, D.D.C., No. 23-cv-00599, complaint filed 3/3/23.

To contact the reporter on this story: Peter Hayes in Washington at PHayes@bloomberglaw.com

To contact the editors responsible for this story: Rob Tricchinelli at rtricchinelli@bloomberglaw.com; Carmen Castro-Pagán at ccastro-pagan@bloomberglaw.com

©2023 Bloomberg L.P.