Nov 13, 2022

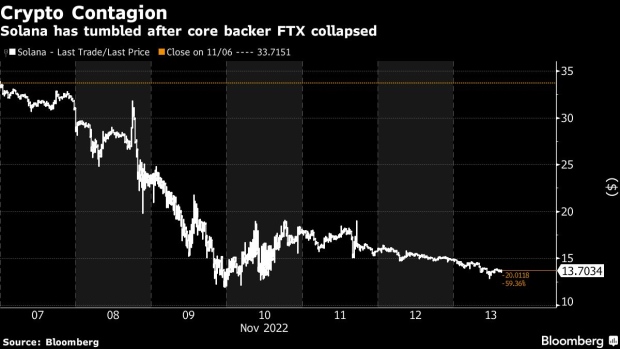

Solana Leads Crypto Slump With FTX’s Serum Project In Distress

, Bloomberg News

(Bloomberg) --

Major cryptocurrencies were mostly little changed after Binance Holdings Ltd.’s Chief Executive Officer Changpeng ‘CZ’ Zhao said the world’s largest digital-asset exchange plans to set up an industry recovery fund.

Zhao said Monday the goal was to “reduce further cascading negative effects” of the bankruptcy of rival exchange FTX, adding the fund will assist otherwise strong projects that are facing a liquidity squeeze.

Bitcoin spiked after the tweet but later paired back some of those gains. At 2:56 p.m. in New York, the token down .9% to $16,200. Earlier, it approached the year’s low following a 3.4% intraday drop. It tumbled 23% last week. Solana, a token associated with Sam Bankman-Fried’s broken FTX empire, snapped a three-day retreat to add as much as 11%, before also paring its increase.

Caroline Pham of the Commodity Futures Trading Commission said the crypto sector suffers from poor risk management.

“It is hard to see where the contagion might stop,” Pham told Bloomberg TV. “More news will come out as people continue to work through their exposures.”

Even though markets gained on Zhao’s tweet, such a fund may not be best for the industry, said Quantum Economics founder and Chief Executive Officer Mati Greenspan. Binance already has too much control in a decentralized market, he said.

“That sort of concentration of power makes me uncomfortable,” said Greenspan. “It’s the kind of thing crypto was designed to avoid and one of the lessons we should have learned from last week.”

Meanwhile, Elon Musk’s tweet that Bitcoin “will make it” also gave crypto markets a boost, said Greenspan. Dogecoin, a token the Tesla CEO has touted in the past, gained as much as 7.9%.

Zhao didn’t mention how big the fund might be. He invited other industry players to “co-invest” and said more details would follow. FTX’s wipeout continues to cast a long shadow after lopping about $200 billion off crypto market value in the past week.

©2022 Bloomberg L.P.