Dec 21, 2022

Some Turkish Banks Are Now Literally Giving Out Free Money

, Bloomberg News

(Bloomberg) --

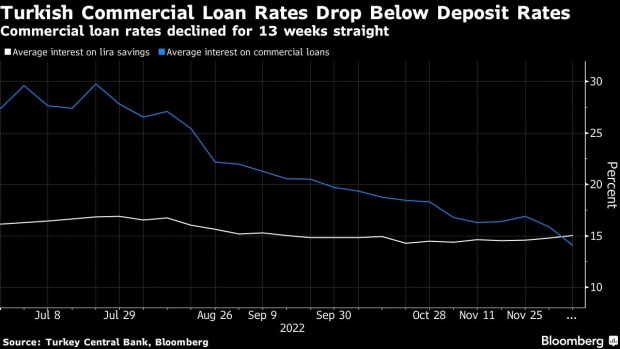

The cost of commercial loans in Turkey fell below the interest rates on lira deposits for the first time since 2019, as the world’s most aggressive easing cycle and new regulations make loans for businesses cheaper.

Nice Credit If You Can Get It in Turkey’s Micromanaged Economy

The weighted average interest rate on commercial credit dropped to 14%, a percentage point lower than one-month deposit rates, according to official data for the first week of December.

The anomaly comes after the Turkish central bank reduced borrowing costs by 500 basis points this year despite consumer inflation that peaked above 85%. Additional regulations forced lenders to offer businesses cheaper credit to boost favored industries ahead of a crucial election for President Recep Tayyip Erdogan.

In its last meeting of the year on Thursday, the central bank will most likely hold its benchmark interest rate at 9%, based on the guidance last month that explicitly stated it was ending its easing cycle following four rounds of reductions. Only Standard Charter Bank in a Bloomberg survey expects a 100-basis-point cut.

Read more: TURKEY PREVIEW: Central Bank to Hold Rates, Add to Toll on Lira

As a result of the bank’s ultra-loose monetary policy and complementary regulations, commercial loan costs have now dropped for 13 weeks in a row, and they are below even one-month deposit rates. It’s a strange position to be in for banks: the money they collect on the funds that they lend doesn’t cover the cost of attracting consumers’ savings.

Cagdas Dogan, Istanbul-based Tera Yatirim’s research director, sees the average commercial loan cost bottoming somewhere around 13.5%. That translates into a negative rate of more than 70% when adjusted for annual consumer inflation of 84.4% last month.

Deposit rates

Unlike the loans, deposit rates slightly rose in recent weeks as banks try to attract more lira savings to meet regulatory requirements.

The weighted average rate for deposits with up to three-month maturity was 22.5% during the week of Dec. 9, the highest since July 2019, according to latest official data.

Regulators warned banks against jacking up deposit rates in October, and officials’ unease might eventually amount to “soft caps” on rates, according to a report by Morgan Stanley economists on Dec. 16.

Read more: Bankers Grill Erdogan’s Lieutenants Over Risky Debt Build-Up

Turkey’s policy mix since last year, dubbed the “Turkey Economic Model” by Erdogan’s allies, is partly aimed at shifting savings from dollars into liras.

Lira deposits made up half of all the savings in the banking system as of Dec. 9, up from just 35% at the beginning of the year, according to the banking regulator’s data.

“Intensifying competition for deposit and simultaneous pressure on lowering lending rates is a toxic cocktail for the banks’ core spreads development in the fourth quarter and into 2023,” Bloomberg Intelligence’s senior banks analyst Tomasz Noetzel said.

--With assistance from Kerim Karakaya.

©2022 Bloomberg L.P.