Aug 6, 2019

Sometimes It Pays to Be the World’s Least Popular Stock Market

, Bloomberg News

(Bloomberg) -- The black sheep of this year’s stock market rally are finally having their moment in the sun.

European equities, also known as the world’s most popular short trade, have been outperforming U.S. peers during the latest market turmoil. The reason? Investor positioning was already so underweight prior to the latest sell-off that it saved the region from a sharper decline.

While the escalation in U.S.-China tensions sent the Stoxx Europe 600 to its worst two-day drop in three years, the gauge has held up better than its U.S. equivalent since the Federal Reserve chairman dented hopes of further easing last week. Through Monday’s close, the European benchmark was down 4.2% in that time, less than a 5.6% decline for the S&P 500.

The Stoxx 600 pared some of those losses on Tuesday, rising 0.6% as China moved to stabilize its currency.

“Given European stocks are a fairly consensus underweight for global asset allocators, the valuations are less challenging,” said Edward Park, deputy chief investment officer at Brooks Macdonald Asset Management. “When we see a sharp drawdown, it tends to be speculative money that leaves first, and given the performance of U.S. equities, the hot money tends to be located there, with those in European equities positioned for expectations of a longer term structural rebound.”

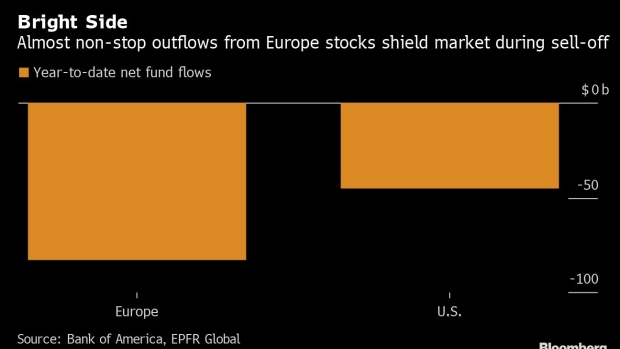

European-focused equity funds have seen almost non-stop redemptions since March 2018, losing about $83 billion this year, compared with an outflow of $45 billion for U.S. funds, according to Bank of America Merrill Lynch and EPFR Global data. Investors have been shunning European stocks due to lackluster economic growth, messy politics and muted profits.

To contact the reporter on this story: Ksenia Galouchko in London at kgalouchko1@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, Paul Jarvis

©2019 Bloomberg L.P.