Mar 31, 2023

South African Rand’s Biggest Rally of Year Is Just the Beginning, Nomura Says

, Bloomberg News

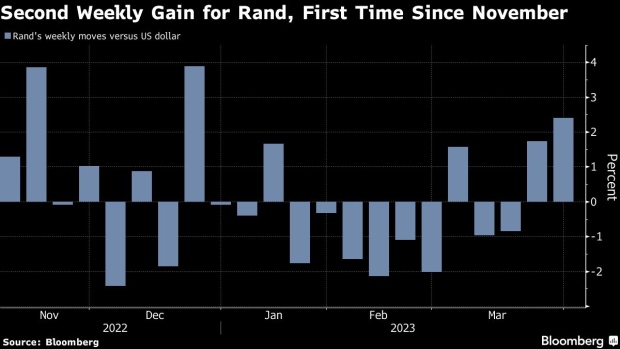

(Bloomberg) -- South Africa’s currency is on track for its biggest weekly gain of 2023, following Thursday’s larger-than-expected interest rate hike. For Nomura, this is just the beginning of the rally.

The rand leaped 1.6% Thursday to close stronger than 18 per dollar for the first time since Feb. 14. It is up another 0.3% today, pushing its weekly gains to 2.2%, the most since Dec. 23.

The jump followed a half-point rate increase Thursday that was double the amount forecast by analysts, bolstering a currency that is still the third-worst performing among 23 major emerging-market peers tracked by Bloomberg this year. Nomura predicted Thursday that the rally will continue, with the rand averaging 17 to the dollar in the second quarter and 16 in the full year. That compares with median forecasts of 14 analysts for the rand to hit 18 by June and 17 by year end.

Analysts at TD Securities and InTouch Capital say Thursday’s hawkish move by the central bank may help anchor the rand, even though it’s likely to weaken into year-end due to global sentiment and local factors including a weakening outlook for economic growth.

If Nomura seems excessively optimistic to them on the rand, in the past it has sinned by being too pessimistic. Back in January of 2016 when the rand was trading around 16 per dollar, the bank predicted the South African currency would slump to 19 by year end. In fact, it did the opposite, soaring to stronger than 14 to the dollar.

Bloomberg’s probability calculator gives Nomura’s second quarter predictions a 53% chance of coming true. The end of year target has a 40% chance.

©2023 Bloomberg L.P.