Jan 19, 2022

South Africans Set for Tough Year as Costs Rise, Stimulus Wanes

, Bloomberg News

(Bloomberg) -- South African consumers are in for another difficult year, with energy and fuel prices likely to surge and the central bank and government set to remove the stimulus that’s helped them cope with the damage caused by the coronavirus pandemic.

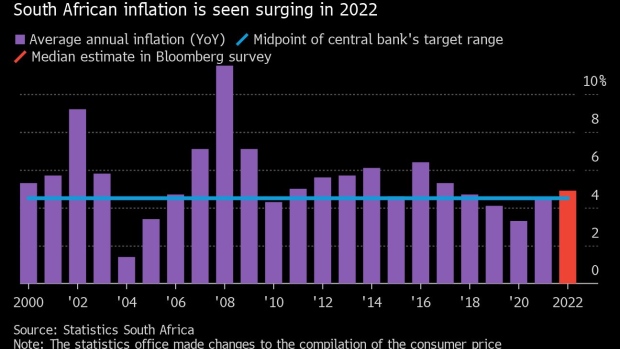

Consumer prices rose 5.9% in December, taking the average inflation rate for 2021 to 4.5%, according to the statistics office. It’s forecast to quicken to 4.9% this year, according to the median of 21 economists’ estimates in a Bloomberg survey.

Headline inflation that’s being stoked by near record-high fuel prices and surging electricity and food costs, may prompt the central bank to raise its key interest rate on Jan. 27, and stick to the aggressive rate-hike trajectory that its modeling shows.

The bank raised the benchmark for the first time in three years in November and its quarterly projection model, which the monetary policy committee uses as a guide, indicated one 25-basis-point increase in each of the next 12 quarters.

While higher rates should reduce the cost of living over the medium- to long-term, they’ll initially hurt households with debt. The ratio of household debt to disposable income stood at 67.8% in the third quarter, central bank data show.

The expiry of a monthly state welfare payment of 350 rand ($22) in March is also expected to weigh on consumers, particularly in the least-affluent income group that earns less than 2,500 rand a month. Its reinstatement after deadly riots in July significantly bolstered sentiment among low-income households in the third quarter.

Increased pressure on consumers would weigh on the recovery of an economy in which household spending accounts for about 60% of gross domestic product.

©2022 Bloomberg L.P.