Nov 30, 2022

South Asia Remittances Drop As Illegal Route Offers More Money

, Bloomberg News

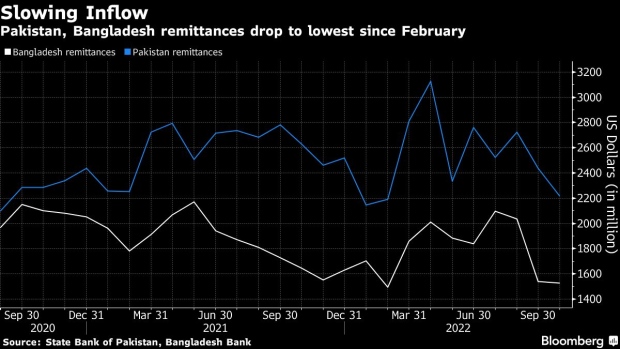

(Bloomberg) -- Remittances to two of South Asia’s largest countries dropped to their lowest level in eight months, with migrant workers finding it more profitable to send money through illegal non-banking channels.

Pakistan’s remittances fell to $2.2 billion and Bangladesh’s to $1.5 billion in October, according to central bank data. Currency rates on the gray market, also known as hawala, are higher than official exchange rates for both countries. That means workers get more local currency when they send funds home through informal channels.

Pakistan’s gap between the two rates has widened in the past few months. The informal channel offers 7% to 10% more in local currency than the official route, said Fahad Rauf, head of research at Ismail Iqbal Securities Pvt Ltd. in Karachi. Bangladesh’s official dollar exchange rate for remittances is 107 taka, compared to at least 110 taka on the gray market.

The discrepancy poses a problem for large swathes of South Asia, where some nations are heavily dependent on remittances from millions of migrants working in the Middle East. The money is crucial for replenishing foreign exchange reserves and financing external deficits.

“The persistent gap is leading to the incentive of switching to the gray market,” Rauf said. Flows to India, however, are typically strong, with migrants sending more money from higher-income nations such as the US and UK.

Several South Asian nations provide perks to keep money flowing through official channels. Bangladesh offers a 2.5% cash incentive and a separate price for remittances that is higher than its interbank exchange rate. Sri Lanka offered to pay an additional 8 rupees per dollar for remittances converted in December of last year.

--With assistance from Arun Devnath.

©2022 Bloomberg L.P.