Jan 31, 2023

South Korea’s Export Decline Persists as Global Economy Weakens

, Bloomberg News

(Bloomberg) -- South Korea posted a record trade deficit in January as exports weakened further, raising concerns the economy may fall into recession amid deteriorating semiconductor demand and persistently elevated energy prices.

The shortfall swelled to $12.7 billion, almost triple the month-earlier figure, as exports slumped 16.6%, data released by the trade ministry showed Wednesday. Shipments of semiconductors plunged 44.5%, while total imports fell 2.6%.

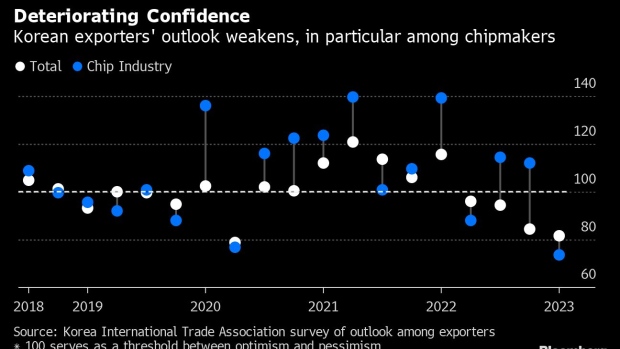

Sluggish exports were at the core of the Korean economy’s contraction in the final three months of last year and may persist for months to come as global consumption slows. Confidence among Korean firms that sell abroad is low and industrial production remains weak as manufacturers adopt a cautious outlook.

“The chance for another economic contraction has gotten greater,” said Park Sang-hyun, an economist for HI Investment & Securities in Seoul. “The deficit hurts not only companies’ bottom line but also consumer spending. It certainly weighs on the economy.”

Citigroup Inc. forecasts a mild recession this winter in Korea.

Resilient exports were a key factor in the Bank of Korea’s confidence that the economy could withstand policy tightening over the past 18 months. The trade numbers bolster the case for an interest-rate pause when the board meets later this month.

With the key rate now at 3.5% — the highest since 2008 — Governor Rhee Chang-yong increasingly sees economic concerns coming to the fore, while the bank wants to keeps policy tight to prevent inflationary pressure from rebuilding.

Korean exports are a major barometer of global trade as the nation produces key items such as chips, displays and refined oil that straddle supply chains. It is also home to some of the world’s largest semiconductor and smartphone makers, and a major downturn is hurting those industries.

SK Hynix Inc., Korea’s second-biggest chipmaker, reported its biggest quarterly loss on record on Wednesday, a day after Samsung Electronics Co. said its operating income dropped by 97% from a year earlier.

The world economy is slowing as a result of rising rates to tackle inflation, as well as Russia’s ongoing war in Ukraine that has fueled oil and food prices. China is also yet to fully recover from its Covid restrictions.

China’s downturn and the drop in semiconductor prices were among major factors hurting Korean trade’s bottom line, along with an increase in energy imports, Finance Minister Choo Kyung-ho said in a statement.

Global demand is likely to remain subdued this year while household debt, fiscal tightening and high borrowing costs constrain Korea’s domestic recovery, Fitch Solutions said in a note.

A turnaround for Korean exports may come from China if the world’s second-largest economy succeeds in reviving its growth engine after an extended period of Covid restrictions. China is the largest buyer of Korean goods that mostly get reassembled to be shipped elsewhere.

Korea’s trade balance is likely to improve in coming months as China reopens, Finance Minister Choo said. Economic activity in China expanded in January as the peak of the Covid exit waves likely passed, Pantheon Macroeconomics said.

Trade is a vital component of Korea’s economy and has far-reaching implications for jobs and consumers. The country’s jobless rate climbed to 3.3% last month from 2.9% in November while gains in employment softened.

--With assistance from Myungshin Cho.

(Adds comments from economist and minister, as well as chipmaker earnings.)

©2023 Bloomberg L.P.