Oct 22, 2022

South Korea’s Top Policymakers to Discuss Credit Market Strains

, Bloomberg News

(Bloomberg) -- South Korea pledged at least 50 trillion won ($34.7 billion) in support for credit markets that have been strained by rising interest rates, stepping in to reduce the risk of defaults weighing on the economy.

South Korea will expand and operate its “liquidity supply program” to prevent a credit squeeze roiling corporate bonds and other short-term money markets, Finance Minister Choo Kyung-ho said on Sunday in a statement, after a meeting with Bank of Korea Governor Rhee Chang-yong and other senior policymakers.

The pledge marks one of the biggest rounds of financial support for markets since Korea expanded its emergency funds to around 100 trillion won to protect businesses at the onset of the pandemic.

“The government and the BOK agree the current market situation is very grave,” Choo said. “We will respond to market anxiety by mobilizing all available policy measures if needed.”

Korea will resume purchasing commercial paper and corporate bonds from Monday, first injecting 1.6 trillion won from a 20 trillion won bond stabilization fund, Choo said. Asset-backed commercial paper related to real estate projects will be among the targets, he said.

Sunday’s meeting underscored the urgency of bolstering confidence in the market after a rare default on commercial paper by the developer of Legoland Korea theme park. The province that houses the park has said it would repay the project’s 205 billion won of commercial paper repackaging loans.

The default added to market unease spurred by rapid interest-rate hikes as the BOK followed the Federal Reserve, as well as the won’s depreciation and a rising trade deficit.

The new support package is a “micro-measure” aimed at boosting confidence in commercial paper markets and does not mean the conditions for monetary policy have changed, Rhee told reporters, according to a recording provided by the central bank.

His comment suggests the BOK remains determined to curb inflation with tighter policy.

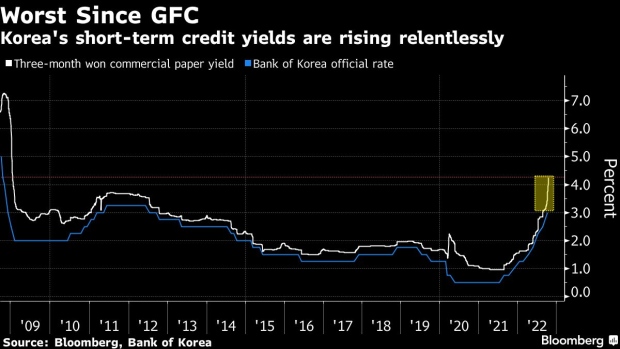

Yields on Korean commercial paper have skyrocketed to a level last seen during the global financial crisis while sales of new won bonds plunged 90% this month, according to Bloomberg-compiled data going back to 1999.

Choo and Rhee were joined by Financial Services Commission Chairman Kim Joo-hyun, Financial Supervisory Service Governor Lee Bok-hyun and presidential aide Choi Sang-mok.

--With assistance from Kyungji Cho.

(Updates with results of meeting)

©2022 Bloomberg L.P.