May 12, 2022

South Korean Won Set for Further Losses After Decade-Low Close

, Bloomberg News

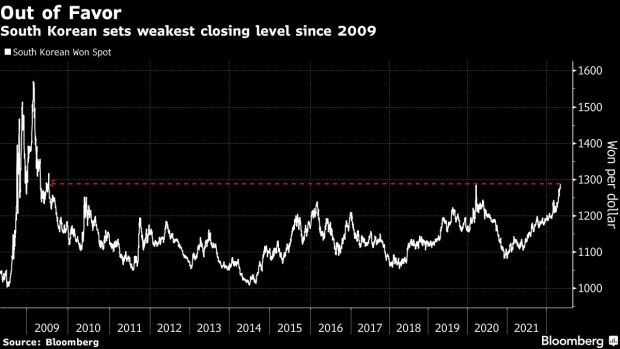

(Bloomberg) -- South Korea’s won is set to extend declines after closing at the weakest level in more than decade on Thursday as the export-driven economy grapples with the impact of China’s Covid lockdowns and high energy prices.

Technical analysis indicates further losses for the won, with the dollar-won pair set to test its 2020 high of 1,296.75. Korea’s currency dropped 1% Thursday to end the day at 1,288.50 per dollar, its lowest close since July 2009, when the country was still in the throes of the global financial crisis.

“The most likely outcome is that the dollar will keep rallying, and that, along with the latest drop in the the yuan, points to macroeconomic circumstances unfavorable for the won,” Oh Chang-sob, a strategist at Hyundai Motor Securities Co. in Seoul, wrote in a research note on Thursday.

The won has weakened 7.7% versus the greenback this year, making it emerging Asia’s worst-performing currency. Elevated oil prices due to Russia’s invasion of Ukraine have weighed on Korea’s energy-importing economy, while China’s Covid lockdowns are raising concerns of a protracted slowdown in South Korea’s largest trading partner.

Korea’s currency slid 3.5% in April alone as local companies paid dividends to overseas investors, and the country recorded another trade deficit. A string of warnings by authorities vowing to take steps to stabilize markets haven’t been enough to limit the won’s declines.

Still, some analysts have suggested the won may soon stabilize given that most of the challenges the currency faces are already priced in.

Korea’s economic fundamentals remain unharmed, according to Ha Keon-hyeong, an economist at Shinhan Investment Corp. in Seoul. The won is likely to see some recovery in the second half of the year, although the rebound may be limited, he said.

©2022 Bloomberg L.P.