Mar 20, 2019

Spain Keeps Strong Growth Despite Europe Woes, Central Bank Says

, Bloomberg News

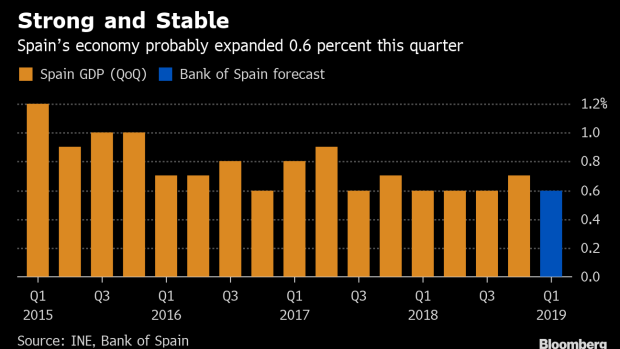

(Bloomberg) -- The Spanish central bank expects the country’s economy to expand by 0.6 percent in the first quarter of this year, the latest sign growth is resisting the slowdown in the rest of the euro area.

The Bank of Spain maintained its annual growth forecasts of 2.2 percent in 2019 and 1.9 percent in 2020, unchanged from the institution’s previous forecasts in December. That is well above Brussels’ projections for the euro area as a whole.

Spain hasn’t been immune to the headwinds battering the rest of the euro zone and the robust growth rate forecast for 2019 is still a slowdown from the 2.5 percent rate of expansion in 2018.

In a quarterly economic update published on Wednesday, the Bank of Spain slashed the contribution of Spanish exports to overall GDP growth by 0.9 percentage point during the next three years through 2021.

The euro zone is Spain’s main trading partner and trade troubles that have hit growth elsewhere in the bloc are expected to continue to decrease demand for Spanish exports. There are already some signs that the negative trade outlook is starting to hit investments across the euro zone, the Bank of Spain notes.

Risks include the absence of clarity on the U.K.’s exit from the EU and "uncertainty over the possible adoption of fresh protectionist measures" at the global level, the Spanish central bank says.

The Bank of Spain also notes that there’s a disagreement among economic institutions such as central banks about whether the weakness in trade and the broader external environment will be more persistent than expected.

Still Spain’s economy has performed better than the central bank expected just three months ago, which has countered the drag on the country’s economic growth caused by external factors such as trade troubles.

Strong momentum from the fourth quarter of 2018, when Spain’s economy expanded by a better-than-expected 0.7 percent versus the previous quarter, has carried over into the first several months of 2019.

Spanish consumers, the motor of Spain’s economy, have continued to bolster spending, buoyed by a steady increase in employment. The Bank of Spain expects the country’s unemployment rate to fall to around 12 percent by the end of 2021 from 14.4 percent in 2018.

Other domestic tailwinds include a drop in the price of oil that has cushioned spenders’ wallets and the European Central Bank’s expansive monetary policy. Many Spaniards’ mortgage loans are variable-rate and rock-bottom interest rates mean they have lower monthly payments. Spaniards’ savings rate has also fallen, a sign they are prioritizing spending over saving.

Despite more Spaniards in the workforce, which has helped to boost salaries, the Bank of Spain downgraded its inflation forecasts. Researchers said that an increase in unit labor costs isn’t translating into the upward pressure on prices that they had expected in December.

The Bank of Spain cut its forecasts for harmonized consumer prices by 0.4 percentage point to 1.2 percent in 2019. It projects inflation of 1.5 percent and 1.6 percent in 2020 and 2021, respectively.

To contact the reporter on this story: Jeannette Neumann in Madrid at jneumann25@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Kevin Costelloe, Ross Larsen

©2019 Bloomberg L.P.