May 29, 2023

Spain Premier’s Local Election Loss Opens Door to Conservatives

, Bloomberg News

(Bloomberg) -- Prime Minister Pedro Sánchez’s Socialist party suffered a massive defeat in Spain’s local elections, handing Conservatives a strong platform for their bid to reclaim control of the national government later this year and giving a boost to Spanish assets.

Alberto Núñez Feijóo’s conservative People’s Party, joined in some places by the far-right Vox, is set to control eight of the 12 regions up for grabs on Sunday, including the bellwethers Madrid and Valencia. The PP also won three of Spain’s largest cities while the Socialists failed to win any major districts.

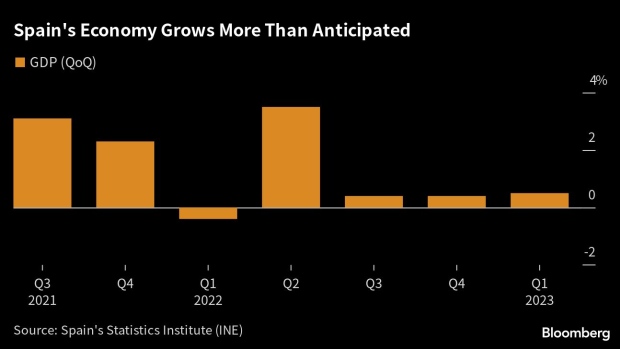

Historically, the party that comes on top in the local election tends to win the national vote, which is expected to be held in December. Sunday’s result could pave the way for the PP to return to power five years after the Socialists ousted them from government, even though Spain’s economy under Sánchez has performed better than expected.

“This is a big wake up call for Sánchez,” Federico Santi, a senior analyst with Eurasia Group, said in an interview. “The left did very poorly and that means the prospect of another left-wing coalition are a lot slimmer now than before local elections.”

Spanish equities outperformed Monday, with the country’s IBEX 35 advancing 0.8% in early trading while the Stoxx Europe 600 index gained 0.2%. Banks including Bankinter SA and utilities including Naturgy Energy Group SA were among the best performers. The yield on on 10-year Spanish government bonds fell 1 basis point to 3.59% on Monday, in line with German peers.

The PP won 31.5% of municipal votes nationwide, up from 22% in 2019, while the Socialists fell to 28%. Vox more than doubled its votes to 7%. Feijóo has promised to be more business-friendly than Sánchez, who has had a contentious relationship with corporate Spain.

“We have clearly won, and taken our first step to usher in a new political cycle in Spain,” Feijóo told hundreds of supporters outside the party headquarter in Madrid late Sunday.

Voters weren’t convinced by Sánchez’s stewardship of the economy, which has outperformed most of its euro-area peers. Sánchez pumped billions of euros into the economy to shield households and businesses from rising costs amid a surge in inflation.

Sanchez’s coalition partner in the national government, the left-wing group Unidas Podemos, came out battered from the election, losing representatives and preventing the socialist’s from retaining key strongholds.

The Spanish government put in place windfall taxes on energy companies and banks as well as a wealth tax to help offset rising costs. Spain has also received more than 50% of the €69.6 billion ($74.6 billion) in grants allocated to it from the European Union’s pandemic-era recovery fund.

The Bank of Spain said earlier this month that it would likely boost its 2023 outlook for expansion above 2%. The resilient economy led the budget ministry to predict that Spain would be able to cut its deficit to 3% of economic output in 2024, a year ahead of target.

The biggest factor complicating December’s general election is the fragmentation of the political center, which has made it unlikely that a single party will be able to gain an absolute majority on its own.

Feijóo will likely have to form an alliance with the anti-migration Vox party to form a government, while Sánchez may have to rely on regional movements and smaller groups on the left such as Unidas Podemos.

©2023 Bloomberg L.P.