Mar 30, 2023

Spanish Inflation Plunges But Core Pressures Highlight ECB Bind

, Bloomberg News

(Bloomberg) -- Spanish inflation plummeted as energy costs retreated, though persistent underlying price pressures underscored the dilemma for the European Central Bank as it weighs how much to raise interest rates.

March’s headline reading came in at 3.1% — down from February’s 6% and much lower than the 3.7% median estimate in a Bloomberg survey of economists.

Core inflation, however — which excludes volatile items like fuel and fresh produce — only dipped a touch, to 7.5%, the statistics institute said Thursday.

German bonds erased gains, with the two-year yield climbing 1 basis points to 2.66% compared with an earlier drop to 2.52%. Money markets held rate-wagers steady, pricing a 3.49% peak in the deposit rate by September, up from 3% now.

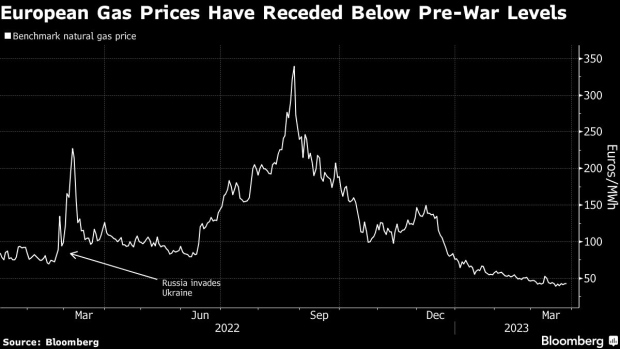

The inflation situation in the 20-nation euro zone is similar to Spain, with the headline and core gauges pulling in opposite directions — primarily because significantly lower energy prices than a year ago are pushing down the overall number.

That’s clouding the monetary-policy path amid what’s already the most aggressive tightening campaign in ECB history. The task for officials in Frankfurt has been further complicated as the tensions gripping banks around the world threaten to hinder credit and curb economic growth.

ECB Governing Council member Peter Kazimir said Wednesday that while the ECB should continue raising rates, it should maybe do so more slowly, citing a “real risk” of banks curbing lending in the wake of the recent financial-industry turmoil.

“Inflation is too high and we have to bring it down,” Executive Board member Frank Elderson told newspaper El Pais in an interview published Thursday.

What Bloomberg Economics Says...

“Spain’s sharp drop is probably largely due to base effects from the energy category and some statistical distortion from the decline in the weight associated to the clothing category in the inflation basket. Looking through this noise, we expect that underlying price pressures remained strong.”

—Maeva Cousin, senior economist. Click here for full REACT

The Spanish data offer a first taste of inflation in the euro zone this month, with numbers from Germany — the continent’s biggest economy — due later in the day, followed by figures from the bloc itself on Friday.

Analysts expect sharp decelerations for both after the spike in natural gas prices that followed Russia’s invasion of Ukraine just over a year ago reversed. Early data from Germany’s most populous state showed a steep slowdown.

--With assistance from Ainhoa Goyeneche, Joel Rinneby and James Hirai.

(Updates markets in fourth paragraph.)

©2023 Bloomberg L.P.