Jan 30, 2023

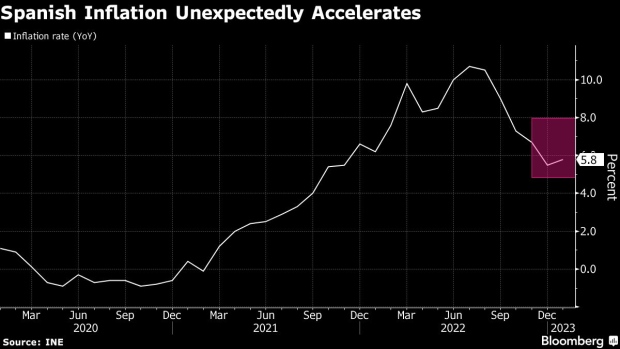

Spanish Inflation Unexpectedly Jumps After Months of Easing

, Bloomberg News

(Bloomberg) -- Spanish inflation unexpectedly quickened in January after a five-month run of slowing price growth, prompting traders to boost their bets on how high the European Central Bank will raise interest rates.

Consumer prices advanced by 5.8% from a year ago, up from the previous month’s 5.5% increase, the statistics institute in Madrid said Monday.

That’s well above the 4.8% median estimate in a Bloomberg survey of economists, though the predictions ranged from 3.8% to 6.5%. The task of forecasters was complicated this month by a re-weighting of the euro-zone inflation basket.

Money markets amped up ECB rate-hike wagers by as much as 9 basis points on Monday, pricing the deposit rate to peak above 3.50% by the middle of the year, up from 2% now. Euro-area bonds sold off, lifting Spanish bond yields about 8 basis points across the curve.

Yields on German 10-year debt, the benchmark for the region, were up as much as 8 basis points to 2.32%, the highest since Jan. 6.

“The higher core inflation is a concern,” said Antoine Bouvet, a rates strategist at ING Bank NV. “That selloff shows that markets are biased toward lower inflation and that release is catching them offside.”

Higher rates bets boosted the euro, which rose 0.4% to $1.0914. That’s just short of the nine-month high the single currency reached last week.

Spain’s acceleration was driven by a rebound in fuel costs and smaller discounts in start-of-year apparel sales. A gauge of underlying prices that excludes volatile items surged to a record 7.5%, suggesting price pressures are still widespread.

That’s the fear at the ECB, which has refocused its attention toward core inflation after a slowdown in the headline gauge. Officials are set to lift rates by another half-point on Thursday, following Wednesday’s release of the euro region’s report on consumer prices.

“It may well be that the December number of HICP, and possibly core inflation, be a little bit lower. But we have good reasons to believe that January and February, for instance, are likely to be higher”

—ECB President Christine Lagarde on Dec. 15. For full transcript of ECB press conference, click here

“The ECB is on track to take another step in their quest for sufficiently restrictive policy setting,” said Rohan Khanna, a rates strategist at UBS Group AG. “Madame Lagarde not ruling out the possibility of higher terminal rate, i.e 4%, would be the most hawkish outcome for now.”

In Spain, the ramp-up in costs has squeezed households and businesses, crimping economic growth. Gross domestic product rose by 0.2% from the previous quarter in the final three months of 2022, data last week showed.

Germany, euro area’s largest economy, may be heading for a recession after all, despite recent optimism due to a mild winter and well-filled natural gas storages. Its economy shrank 0.2% at the end of last year, data showed Monday, a worse outcome than previously flagged.

What Bloomberg Economics Says...

The surprise jump in Spain’s headline EU Harmonized inflation at the start of the year suggests the fall in price growth won’t be as fast as we expected. The economy posted a mild GDP gain in the last quarter of 2022, and we expect it to grow again in the first quarter, helped by lower inflation. The risk is that cost pressure proves stickier than we forecast.

—Ana Andrade, economist. For full react, click here

--With assistance from Joshua Robinson, Joel Rinneby and James Hirai.

(Updates market moves, adds analyst comment in 9th paragraph.)

©2023 Bloomberg L.P.