Jun 13, 2021

Spending Surge Might Be Just What Stocks Need to Hit New Heights

, Bloomberg News

(Bloomberg) -- Plans for the biggest corporate spending boom in more than a decade could be the next driver for stock markets trading at record highs.

Last year’s prudence among companies is giving way to jubilant investment across a swath of industries, driven by economic reopenings, low interest rates and government support. Such a signal of confidence in the future is making the likes of JPMorgan Chase & Co., State Street Global Markets and Invesco Ltd. optimistic that equity investors can reap even greater rewards than they’re currently enjoying.

Evercore ISI’s latest survey of chief financial officers in the U.S. showed that capex plans for this year were the highest since 2002. In Europe, companies excluding financials and real estate investment trusts, are set to shell out 467 billion euros ($568 billion) in 2021, the most since 2007 and a jump of 26% from last year, according to Bloomberg Intelligence. Industries from autos to utilities and tech are set to benefit, depending on who you talk to.

“You can think about these increased capex plans as a little bit of a signal of corporate health, as a signal of management optimism about the future, which is positive for the market,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “The market is rewarding companies that can continue to invest.”

Evidence of that isn’t hard to find. A Goldman Sachs basket of S&P 500 stocks with the top capex and research spending is up 26% this year, compared with a 16% increase for those paying the biggest dividends.

And executives are taking note: The share of CFOs in Evercore’s survey that plan to preserve cash in the second half of this year fell to 18% in June from 37% a year ago, while 33% said they’ll invest in capex versus 22% a year ago.

“The global economy is growing, and that is a time when companies have more money to spend and are more optimistic,” said Kristina Hooper, Invesco’s chief global market strategist. “Companies are likely to ramp up capital spending to compensate for under-investing during the pandemic.”

U.S. and European equities have been range-bound near record highs since mid-April, and JPMorgan strategists led by Mislav Matejka expect higher corporate spending to give stocks a boost. They see capital expenditures staging a strong recovery on the Biden administration’s infrastructure plan and upcoming payments from the European Union’s Recovery Fund.

Which sectors and individual stocks will benefit most is the subject of debate. State Street’s Veitmane sees cyclicals such as materials, industrials and auto manufacturers as potential winners, while Bloomberg Intelligence analyst Kaidi Meng points to utilities and telecoms, which are leading other industries in terms of rising spending this year, both in Europe and the U.S.

Invesco’s Hooper sees tech as being among the main beneficiaries. Apple Inc. plans a 20% increase in U.S. investments over the next five years, while Intel Corp. seeks to boost capital expenditure by about 43% to as much as $20 billion in 2021. In the Evercore survey, CFOs’ plans to spend on information technology especially stood out. State Street’s Veitmane expects semiconductor firms to win from higher investments amid chip shortages.

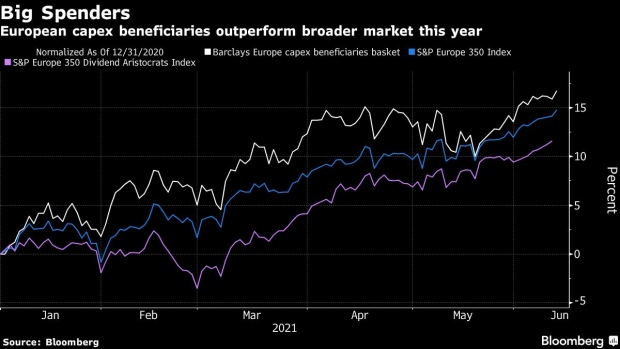

According to Barclays Plc strategists, the rebound in capex across sectors is likely to be “uneven,” as are the potential beneficiaries. They have created a basket of European stocks that they see as having most to gain, which includes oil services firm SBM Offshore NV, chipmaker Infineon Technologies AG, plane maker Airbus SE and online grocer Ocado Group Plc. The basket is up 17% year-to-date compared with the Stoxx 600 Index’s 15% advance.

Not all spending plans have had a warm reception. Vodafone Plc shares sank 8.9% on May 18 as analysts worried that the telecom operator’s higher capex could pressure its free cash flow, while Iliad SA’s spending plans also weighed on its shares that same day. Likewise BT Plc’s raised goal to roll out fiber optic connections also got the cold shoulder.

According to New York Life Insurance Co. portfolio strategist Lauren Goodwin, some investment projects might not end up being successful, reducing a company’s cash without any future revenue-generating benefit.

Still, at a time when the world is emerging from lockdowns and earnings forecasts are surging, investors are favoring companies that are putting money into their own improvement and scale.

“As quality growth investors, we tend to gravitate toward companies which continuously invest in innovation to sustain or improve their strong competitive advantage,” said Olga Bitel, a global equity strategist at William Blair Investment Management.

©2021 Bloomberg L.P.