Dec 3, 2020

Splunk Results Look Even Worse Against Blowouts From Peers

, Bloomberg News

(Bloomberg) -- Shares of security software companies mostly rose on Thursday, following strong results from a trio of notable names, but Splunk Inc. was a stark exception to the advance, cratering after its results were seen as shockingly weak.

The timing of the reports meant that Splunk could be viewed against its industry peers, resulting in a comparison that analysts said proved unflattering.

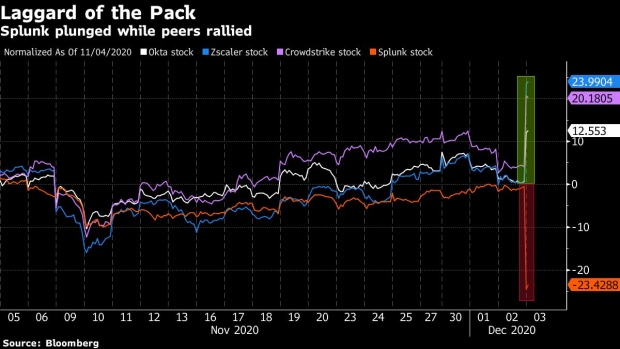

The divergence could be seen in the reaction of the stocks. While Okta Inc., Zscaler Inc., and Crowdstrike Holdings Inc. all jumped to records with double-digit advances, Splunk collapsed as much as 26%. Prior to the day’s move, the four had tracked each other fairly closely over the past month.

In its report, Splunk’s chief executive officer referred to “uncertain market conditions,” while the finance chief said “the environment was a challenge in the quarter.” Analysts argued that these headwinds didn’t appear to impact Splunk’s peers in the same way.

Despite claims of “ongoing macro pressure,” Mizuho Securities wrote, Splunk “appears to be more of an outlier” in this regard compared with its peers. Stifel wrote that “given solid prints across the broader group” -- including Okta, Zscaler and Crowdstrike -- Splunk’s issues “are company-specific and not indicative” of broader concerns for the security space.

BTIG wrote that Splunk’s explanation “is fairly confusing given that most peers in the software space (and particularly in security software) saw relatively strong trends” in the quarter. BTIG, Stifel and Mizuho all downgraded the stock, as did JPMorgan, which wrote that it had been “blindsided” by Splunk’s report.

Outside of Splunk, security results were seen as strong. Wedbush wrote that the “blowout earnings from the trifecta of Zscaler, Crowdstrike, and Okta” represented a “seminal moment” for the industry, one where tailwinds were “still in the early days of playing out.”

The strong results from the trio “bodes well for cyber names heading into 2021,” analyst Daniel Ives wrote.

©2020 Bloomberg L.P.