Mar 20, 2023

Sprott Sees Gold Hit Fresh Record as Banking Crisis Unfolds

, Bloomberg News

(Bloomberg) -- Gold prices could surpass the record set at the height of the Covid-19 pandemic if ongoing turmoil in the banking sector persists and global central banks downshift their interest-rate hiking cycle, according to Sprott Inc., a top investor in the bullion industry.

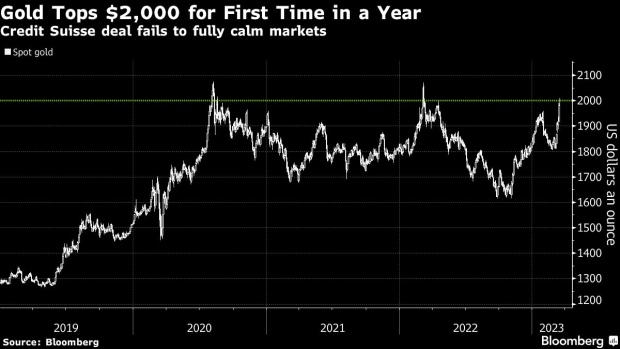

The haven asset briefly rose above $2,000 an ounce on Monday for the first time in a year as a deal to buy Credit Suisse Group AG failed to calm fears over the global banking industry. Concerns over contagion among US regional lenders have sparked bets that the Federal Reserve may slow the pace of monetary tightening, which usually means the price of gold is headed up.

“I certainly think we’re on our way to new highs,” Sprott’s Chief Executive Officer Whitney George said in an interview. After a market downturn, “the minute liquidity is restored back into the global market, gold seems to be always be the first thing to recover, and then often hits new highs.”

Spot gold reached an all-time high of $2,075.47 in August 2020 as investors sought safety in the precious metal when the world was struggling through the pandemic.

©2023 Bloomberg L.P.