Mar 20, 2023

Sri Lanka Gets $3 Billion IMF Bailout as Debt Talks in Focus

, Bloomberg News

(Bloomberg) -- The International Monetary Fund approved a $3 billion loan program for Sri Lanka to bolster its economy and urged for swift progress in talks on debt structuring between the bankrupt nation and its creditors.

The lender’s executive board approved the 48-month program in Washington, and officials said it will include a disbursement of about $333 million in the next two days or so. The bailout will inject much-needed funding for a nation grappling with soaring prices, supply shortages and eroded foreign-currency reserves after defaulting on its overseas debt last year.

The bailout approvals come after the IMF’s nearly six months of discussions with the South Asian country that has sharply hiked interest rates and shifted to a more flexible currency exchange while finally persuading its biggest creditor China to support the debt restructuring.

“We have been deeply concerned about the impact of the crisis on the Sri Lankan people, particularly the poor and vulnerable groups, and about the economic costs of the delay in the country’s access to external financing,” Peter Breuer, the IMF senior mission chief for Sri Lanka, said in a briefing on Tuesday.

“It is now important for the Sri Lankan authorities and creditors to closely coordinate and make swift progress towards a debt treatment that restores debt sustainability,” he added.

Disbursements by the multilateral lender to Sri Lanka will now be tied to six month reviews across the duration of the program. Sri Lanka’s central bank said the program would give access to up to $7 billion in funding from the IMF and other international financial institutions.

Bonds due in 2030 rose 0.47 cents to 36.22 per dollar on Tuesday, ending three days of losses.

Sri Lanka is expected to unveil a restructuring strategy by end-April together with its financial advisors and the country will need to decide whether it will include local currency debt, Breuer said.

“So whether local debt is included in there or not, it’s for the authorities to set up,” he said. “What we worry about of course is whether there’s any implications with respect to the economy or financial stability. So that is the angle we would be looking at.”

Fitch Ratings has said the debt talks may drag as not all creditors agree on including local-currency sovereign borrowing in the restructuring. The rating company cut its score on rupee debt in December, saying a default was probable.

The country is expected to have about $56 billion in external debt, or about 75% of its gross domestic product, this year, according to IMF estimates. In the mean time, private creditors are considering a proposal to swap defaulted bonds with new securities that would have cash flow linked to the nation’s future growth, according to people familiar with the matter.

Better Days

Sri Lanka’s government cheered the news with Foreign Minister Ali Sabry saying in a tweet on Monday that “we’re well on our way towards better days.”

The development comes as debt-relief talks for other vulnerable nations such as Zambia have stalled. The main sticking point for talks on several fronts has been a disagreement between China, the biggest creditor to emerging economies, and traditional lenders led by the US on whether loans from multilateral institutions like the World Bank can be restructured.

Read more: ‘Lost Decade’ Looms as US-China Face Off Over Debt Relief

Sri Lanka defaulted on its overseas debt for the first time in May last year and suspended all outstanding payments to bond holders and bilateral creditors. The country has a long track record with the IMF, securing 16 bailouts since the 1960s with the last one in 2016.

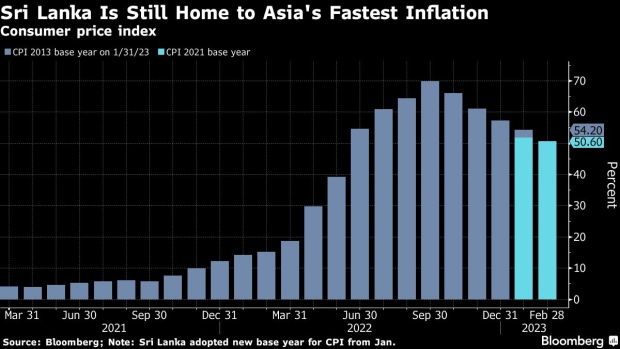

While shortages in Sri Lanka have eased, inflation has somewhat cooled and reserves have inched up to $2.2 billion in February, the nation needs the IMF loan to turn the corner after falling into a deep recession in 2022.

Since the IMF’s staff-level agreement in September, Sri Lanka has increased taxes, cut energy subsidies and returned to a more flexible exchange-rate regime to meet IMF conditions. The nation also increased borrowing costs to the most since August 2001 to rein in Asia’s fastest inflation.

“With external financing coming in, we believe the government’s domestic borrowing requirement will fall, having a positive impact on domestic rates,” said Udeeshan Jonas, chief strategist at Capital Alliance group in the capital Colombo.

Sri Lanka’s President Ranil Wickremesinghe said in a tweet his government was committed to full transparency to achieve sustainable levels of debt and push through a reform agenda.

But some of those changes have raised concerns. Several civil society organizations on Monday sent a letter to the IMF detailing their worries over the impact of austerity moves on the population, as well as calling for greater transparency in how the funds will be disbursed.

IMF officials said that Sri Lanka will be subject to an in-depth governance diagnostic review, which will assess corruption and governance issues and provide recommendations.

“We emphasize the importance of anti-corruption and governance reforms as a central pillar,” Breuer said. “They are indispensable to ensure the hard-won gains from the reforms benefit the Sri Lankan people.”

--With assistance from Asantha Sirimanne, Sydney Maki, Karl Lester M. Yap, Malavika Kaur Makol and Ruchi Bhatia.

(Updates with comments from the central bank and fresh market moves. An earlier story corrected Sri Lanka Foreign Minister’s name.)

©2023 Bloomberg L.P.